Sellers’ Duties With Inspection Reports

The PAR Legal Hotline has seen an uptick in calls about sellers refusing to look at or review inspection reports from failed transactions even though the Agreement of Sale says that buyers are to provide copies of reports if they are obtained as part of the inspection contingency. There are several questions about sellers’ duties or responsibilities to review those reports when there is a new buyer. Let’s clear a few things up.

First, the Seller’s Disclosure Law requires that a seller shall disclose to the buyer any material defects with the property known to the seller by completing all applicable items in a property disclosure statement (Form SPD). A material defect is a problem with the residential real property that would have a significant adverse impact on the value of the property or involves unreasonable risk to people on the property.

More importantly for this article, Section 7307 says that if the initial disclosures are “subsequently rendered inaccurate prior to final settlement as a result of any act, occurrence or agreement subsequent to the delivery of the required disclosures, the seller shall notify the buyer of the inaccuracy.” Though the law doesn’t specifically state how this must happen, the most common options would be to either update the seller disclosure form itself (by adding/changing information in the disclosure or using a form like the Seller’s Property Disclosure Statement Addendum (Form SDA)

If the seller is telling you, as their agent, that they refuse to receive or look at the inspection reports in a transaction, the first question you should be asking them is, “Why?” Sometimes, the follow-up answer is, “Well, if I don’t physically see the inspection reports, then I have no knowledge and don’t need to update my disclosures.” But that is generally wrong.

The seller’s failure to comply with the seller’s disclosure law, either willfully or negligently, can result in actual damages, punitive damages and, just for fun, the court can apply other remedies applicable under other provisions of law. Willfully refusing to look at inspection reports – especially where a buyer terminates an agreement of sale based on those reports – could be seen by a court as contributing to a violation of the law because the seller willfully avoided updating the seller’s disclosure statement by ducking the knowledge that the contract says they should be getting.

If there is an inspection report from this transaction known to the seller, it’s likely in the seller’s best interest to review the report and update the seller’s disclosure statement appropriately. This prevents any potential legal argument that the seller failed to comply with the law. The seller might also consider providing some or all of the report along with the SPD to better inform buyers of the information that was discovered during the inspection.

On the flip side, is the seller required by law to hand over the inspection report to a new potential buyer? Nope. They potentially could provide some or all of the inspection report, but buyers have no legal right to demand copies of reports prepared for other buyers. The seller’s only obligation is to make sure any knowledge of material defects is updated and provided to the buyer. If the seller wants to refuse the receipt and review of the inspection reports, you might consider whether or not you want to continue representing them. Remember, though a licensee is generally not going to be liable for a seller’s failure to disclose defects, that protection disappears where “the agent had actual knowledge of a material defect that was not disclosed to the buyer or of a misrepresentation relating to a material defect.” Alleged seller disclosure violations are a top source of buyer/seller mediation and of lawsuits against both sellers and licensees, so it is vital to have transparent conversations with your sellers about the potential legal risks for declining to review inspection reports to avoid updating the seller’s disclosure statement.

Topics

Share this post

Member Discussion

Recent Articles

-

Winter Maintenance: Chimney and Heating Tips

- October 23, 2024

- 3 min. read

Experts share their insights and advice for the maintenance of chimneys and HVAC systems.

-

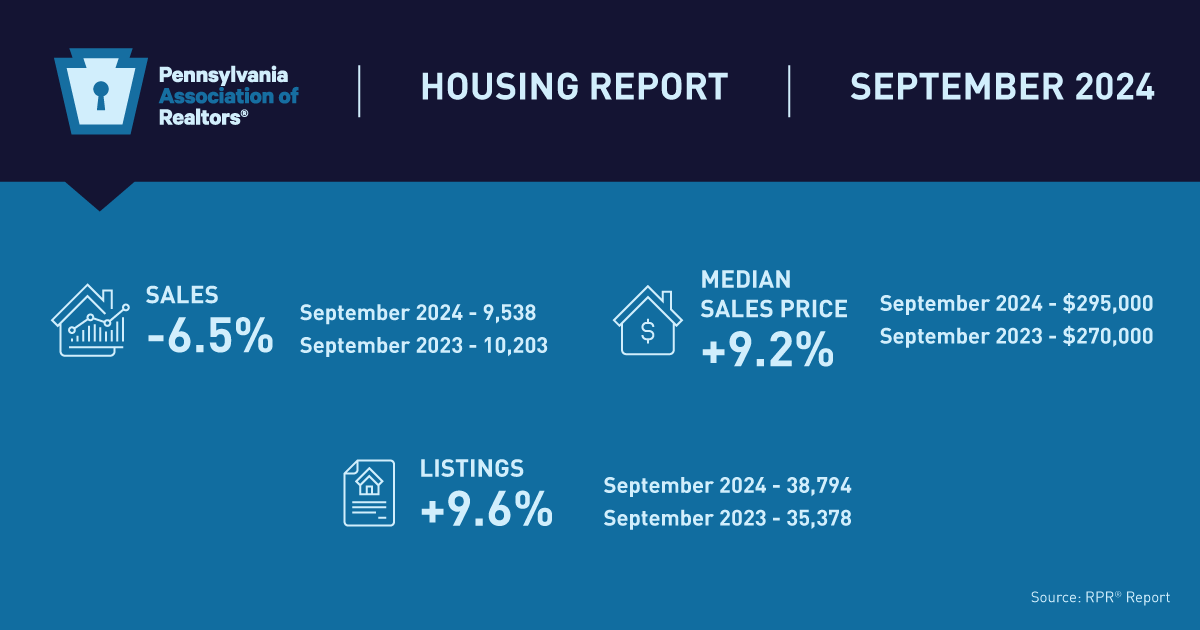

Pennsylvania Median Home Sales Price Dips Slightly, More Listings Hit the Market

- October 22, 2024

- 2 min. read

The Pennsylvania Association of Realtors®’ September housing market report shows home prices have come down a bit, but the good news is there are more homes on the market.

-

Generation E(xpat)? More Gen Z, Millennials Moving Abroad

- October 21, 2024

- 1 min. read

A recent survey showed 87% of Gen Z and millennial workers were planning on becoming digital nomads – people who work remotely while traveling.

Daily Emails

You’ll be the first to know about real estate trends and various legal happenings. Stay up-to-date by subscribing to JustListed.