Policies

Policies That Impact You

PAR has adopted numerous policy statements on issues that impact you and your business and has created different programs to help you and your associations advocate on behalf of your industry and consumers.

PAR Policy Statements

The Pennsylvania Association of Realtors® has adopted policy statements on:

Affinity Programs

PAR’s Board of Directors adopted a policy statement and implementation plan on the collection of real estate referral fees during the May 1999 business meetings, mirroring a similar statement and plan adopted by the Association of Real Estate License Law Officials (ARELLO). This statement and plan are intended to provide guidance to licensees on the issues of referral fees, after the fact referral fees and interference with brokerage relationships.

Additional Resources:

Affordable Workforce Housing

Availability of housing for those of all income levels is critical for balanced and healthy growth of the commonwealth and its communities. PAR favors the development of workforce housing for everyone, with special attention to the needs of low-income and working households.

Additional Resources:

Climate Change

Climate change policy development should include protecting private property rights, maintaining affordability/availability and smart growth principles. Environmental initiatives should not be barriers to the ability to own, use and transfer property. The association opposes transaction-triggered mandates and requirements that impose undue economic impact on property owners, managers and tenants.

Additional Resources:

Comprehensive Land Use Planning

PAR believes better communities are achieved through quality growth, sustainable economies and housing opportunities that embrace environmental standards. To achieve this, PAR supports: providing housing opportunities and choice, building better communities, protecting the environment and implementing fair and reasonable public-sector measures.

Additional Resources:

Document Filing Fee Increases

PAR believes a recording fee levied only on a homebuyer is a much greater burden than that from a more broad-based tax designed to generate the same amount of revenue. PAR has concerns about accumulating fees on the real estate transaction and opposes additional fees when they are not integrally associated with the improvement of the industry.

Additional Resources:

Education and Economic Development Funding Options

Pennsylvania collects nearly $10 billion in property tax revenue, a figure that represents almost two-thirds of all local taxes collected in the state. The lack of other broad-based local taxes has led to significant reliance on property taxes to fund education. PAR recommends these potential solutions to offset dependence on the property tax: provide a dedicated funding source, provide an equitable distribution formula, eliminate unfunded mandates, hold schools accountable for spending, contain healthcare costs, implement taxpayer referenda on future increases, reduce taxes on primary residences and establish countywide property assessment guidelines.

Additional Resources:

Eminent Domain

PAR works diligently to protect an individual’s right to own and maintain property and to appropriately limit government reach and ability to take that property. While PAR recognizes that governments may need to take private property for public use to provide, for example, hospitals, municipal buildings or public utilities, the association believes that government use of eminent domain power should be limited and closely monitored.

Additional Resources:

Impact Fees

PAR believes that impact fees are detrimental to consumers and therefore opposes any expansion or increase of existing fees. While impact fees may benefit a community, they also increase the overall cost of housing. Impact fees can reduce the number of buyers able or willing to pay and can have devastating effects on local real estate markets.

Additional Resources:

Landlord and Tenant Issues

PAR is opposed to additional mandates that would impose additional disclosure duties and costs, as well as incur potential liability for landlords and possibly for any party (except the tenant) associated with the leased property (including sellers, purchasers, and property managers). Additional disclosure requirements could entail from two to four additional forms in any lease transaction, as well as extensive revisions to accompanying notices in the residential lease and agreements of sale.

Additional Resources:

LGBTQ Non-Discrimination

PAR opposes discrimination and believes that all people should be treated fairly and with respect. PAR supports updating the Pennsylvania Human Relations Act to include prohibiting discrimination on the basis of sexual orientation, gender identity or expression.

Additional Resources:

License Renewal

In Pennsylvania, real estate licensees must renew their licenses on a biennial basis. The Governor and the General Assembly are consistently investigating avenues to accumulate budgetary funds. One such avenue would require individuals to gain tax clearance in order to renew licenses, permits and registrations. While PAR does not condone tax delinquency, as a licensed profession, REALTORS® would be extremely impacted with passage of any legislation seeking to require tax clearance for renewal of licenses.

Additional Resources:

Point-of-Sale

PAR believes point-of-sale inspections are inequitable because they place a burden on homeowners and sellers. They are inefficient in achieving the highest level of compliance with local code standards and they’re counterproductive to maintaining affordable housing.

Additional Resources:

Private Property Rights

The fifth amendment of the U.S. Constitution says, “No person shall… be deprived of life, liberty or property without due process of law; nor shall private property be taken for public use without just compensation.” As the cornerstone belief of the real estate industry, preserving real estate property rights has been part of the mission of PAR since its inception. The association opposes any actions that weaken an individual’s right to own and preserve private property.

Additional Resources:

Property Tax Assessment Reform

PAR supports consolidating the assessment laws into a single statute while allowing for flexibility between the county classes, a state assessment system with a uniformity office which oversees and enforces compliance, and the adoption of a uniform and computerized mass assessment system. PAR believes the sale of property should not be the sole basis for an assessment appeal by a taxing authority.

Additional Resources:

Realty Transfer Tax

PAR opposes realty transfer tax increases along with any and all other financial roadblocks that may be placed in the way of potential homeowners. We encourage repeal of existing taxes because they are a burden to buyers and sellers of real estate, especially at the time of closing.

Additional Resources:

Sales Tax on Services

PAR believes that applying the state sales tax to real estate services, including appraisal fees, home inspections and credit reporting, would drive up the cost of housing and thus reduce demand. Such a tax would increase closing costs on the transfer to existing residential and nonresidential property, increase the cost of operating a business brokerage and increase the cost of new single-family and multi-family housing.

Additional Resources:

Seller Disclosure

The Real Estate Seller Disclosure Law applies to sellers who want to transfer any interest in real estate composed of one to four residential dwelling units. The disclosure statement is designed to assist the seller in complying with the disclosure requirements and to assist the buyer in evaluating the property. PAR believes that any amendment to the form should be addressed by the Pennsylvania Real Estate Commission rather than the legislature.

Additional Resources:

Short-term Rentals

The continued strength of our nation’s economy depends on the preservation of the right to freely own, use and transfer real property. The Pennsylvania Association of Realtors® recognizes the need to address short-term rental regulations in order to balance private property rights while promoting the safe and quiet enjoyment of neighborhoods.

Additional Resources:

Urban Renewal

PAR supports legislation to eliminate blighted neighborhoods, increase affordable housing opportunities and prevent code violators from expanding their ownership of blighted property. PAR opposes overbroad and/or unreasonable restrictions that target a limited sector of the public and provide little relief from blight, including denial of a state permit, variance, license or approval that may hold a licensed professional to a higher standard than the general public.

Additional Resources:

Latest Content

-

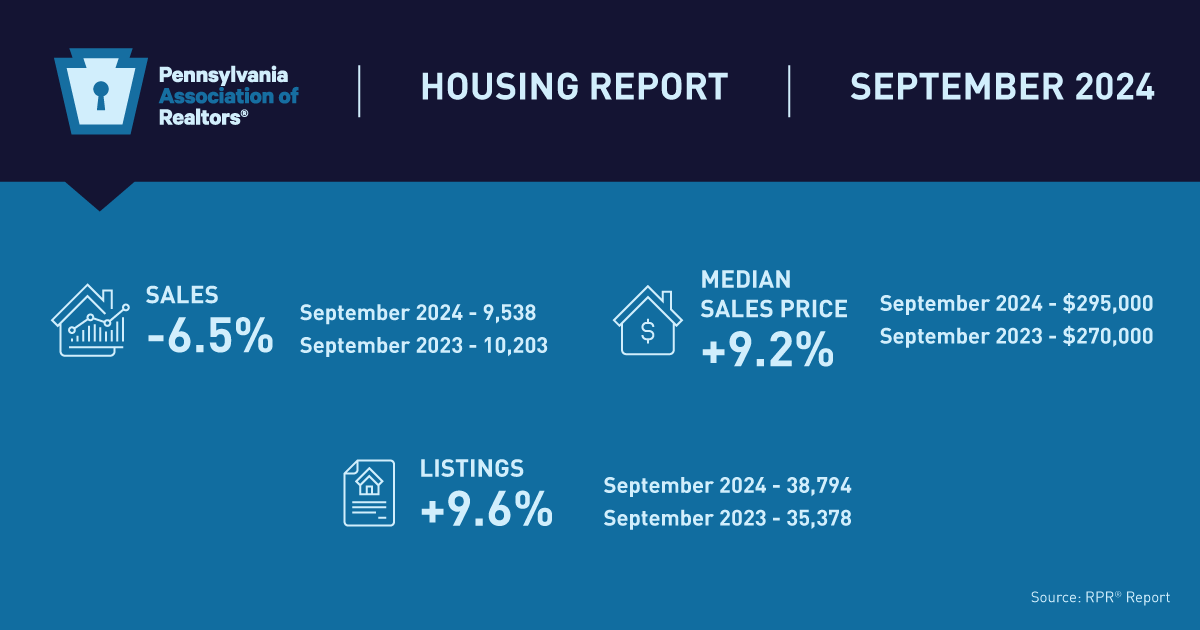

Pennsylvania Median Home Sales Price Dips Slightly, More Listings Hit the Market

- October 22, 2024

- 2 min. read

The Pennsylvania Association of Realtors®’ September housing market report shows home prices have come down a bit, but the good news is there are more homes on the market.

-

Generation E(xpat)? More Gen Z, Millennials Moving Abroad

- October 21, 2024

- 1 min. read

A recent survey showed 87% of Gen Z and millennial workers were planning on becoming digital nomads – people who work remotely while traveling.

-

Realtors® Reveal: 5 Renovation Mistakes Sellers Should Avoid

- October 18, 2024

- 3 min. read

Here are five renovation mistakes sellers should avoid, according to a few Pennsylvania Realtors®.