Dealing with Disasters

In light of the train derailment in East Palestine, Ohio, Realtors® may have some questions about whether and how this might affect real estate transactions and their responsibilities as licensees. Though the specific details of this incident are unique, most of the underlying compliance issues are the same as they would be for any sort of disaster (where “disaster” here is just a generic term for “a catastrophic event out of the property owner’s control”).

Q: What sorts of things are sellers required to disclose after a disaster?

A: It depends on what happened and, more importantly, how it actually affected the property in the transaction.

There is no general requirement that sellers must disclose what we’ll just call “the fact that something bad happened somewhere near here.”

The Real Estate Seller Disclosure Law (RESDL) says that sellers must disclose certain “material defects with the property known to the seller…” A “material defect” is defined in section 7102 as “a problem with a residential real property or any portion of it that would have a significant adverse impact on the value of the property or that involves an unreasonable risk to people on the property.”

The key words there are that defects must be problems “with the property,” as in… an issue that physically (or legally) affects the actual property involved in the transaction. So for starters, a seller would need to disclose if the disaster appears to have had some sort of physical impact on the property that they are trying to sell or if it created a specific legal issue affecting title. That could mean things like actual damage to the property (tornado takes a roof off, decontaminating chemical residue from the house) or certain impacts related to the property (contaminated well or public water service). The easiest place to start is by looking at the Seller’s Property Disclosure Statement (Form SPD) to see what questions might apply.

Q: Does PAR have a special form for disclosing disaster-related issues?

A: No. The necessary disclosures generally can be done on existing forms. For example, if a property has water, air and/or soil tests done to detect the possibility of hazardous substances, there are already questions for those specific disclosures right in Form SPD. If a tornado peels off part of the roof or pushes water into the basement, there are already questions that cover the roof and basement. There’s even a question about whether there have been insurance claims filed. And if there’s ever anything you can’t find on the SPD you can always use the Seller’s Property Disclosure Statement Addendum (Form SDA) to add anything else that may be relevant.

Let’s use the train derailment in February of 2023 as an example. Paragraph 21 of the disclosure form is titled Hazardous Substances and Environmental Issues. Subsection (F) has questions asking if the seller is aware of “past or present hazardous substances,” “other hazardous substances or environmental concerns that may affect the property” and “testing on the property for any other hazardous substances or environmental concerns.” If state and/or federal health officials or private inspectors have done things like tested an owner’s well water or taken swabs from countertops, then the owner clearly needs to disclose that testing has been done. If testing comes back negative, then the seller still needs to disclose the tests, but they would be able to check “no” to the question about the presence of hazardous substances since they have no evidence of a problem. Of course, if the test is positive, then this answer is “yes,” and the seller would want to provide further clarification. This is all highly dependent on the specific condition of each property.

Q: Does a seller have to disclose things that occur after their original seller disclosure form is filled out?

A: Yes. The law requires sellers to update disclosures if they are “rendered inaccurate prior to final settlement” and to notify the buyers of the change. That can be done by changing and initialing the original form (and making sure the buyer receives a copy, of course), or by filling out and providing the Seller’s Property Disclosure Statement Addendum (Form SDA) or just by writing out an explanation that gets appended to the disclosure form.

Q: OK… you’ve said that the seller doesn’t have to disclose certain things, but can they give more information if they want to? And should they?

A: Absolutely. It can often be smart for sellers to disclose certain facts in advance if they are concerned that buyers might be upset or suspicious to learn about them later in the transaction or after closing. For example, if a tornado destroyed part of a neighborhood – but not the house for sale – it could be helpful to disclose the fact of the tornado because it gives an opportunity to note that this property was unaffected. Or if there was a nearby chemical spill, advance disclosure of the original incident could allow buyers to conduct any desired tests during their inspection period so they can be confident in the purchase.

As to what extra information the sellers should disclose, we would leave that to a discussion between the sellers, their agent and possibly their attorney. There are countless scenarios in which sellers are not required to disclose certain information (murder or suicide on a property, noisy neighbors, nearby train tracks), but they choose to do so out of an abundance of caution because they know future buyers may still be upset if they find out later. If there are concerns that buyers may be upset to learn of something that happened nearby it may be helpful to provide that information up front, but the method could vary from transaction to transaction. Brokers with specific concerns about local or regional issues should consult with brokerage counsel about whether they want to create some sort of brokerage form addressing those issues.

Q: What should I tell buyer and seller clients about whether and how a particular property was affected?

A: Unless you are an environmental engineer, chemist, etc., you don’t want to be telling your clients – buyer or seller – whether a particular property has or has not been affected by a disaster. The role of the agent/broker is to get the clients to the appropriate resources so they are able to conduct their own due diligence and come to their own conclusion.

Specific to the train derailment in East Palestine, the Pennsylvania Department of Environmental Protection has a thorough resource page that should be a good first resource for most buyers and sellers. It includes a summary of some of the main issues, plus a number of helpful links to the Environmental Protection Agency emergency response page, the “Train Derailment Dashboard” from the Pennsylvania Emergency Management Agency and a detailed 10+ page FAQ from the DEP and the Pennsylvania Department of Health.

These documents contain things like a discussion of where and how regular air, water and soil samples are being taken, whether and where high-test results have been found and common-sense cleaning suggestions. The state and federal government resources will be updated as more information becomes available.

Q: Will PAR be producing health-related information for members and/or their clients?

A:No. See above – we are recommending that licensees rely on existing and updated government documents and guidelines as they become available. Of course, PAR will pass on any state mandates that might be issued to ensure that members are fully informed.

Q: Will my buyers actually be able to close on properties that may have been affected by a disaster?

A: Great question, and again – it depends. If there is physical damage to the property the Maintenance and Risk of Loss provision (paragraph 18 in Form ASR) could apply. But any disaster could cause enough of an issue that an insurer, title company or lender raises red flags about the property even if there is no obvious physical damage to the property. For example, lenders may pause underwriting decisions in the immediate aftermath of a disaster if they are unsure about how overall property values might be affected, even if your specific property hasn’t been directly touched. Insurance companies may not be willing to issue a policy unless and until they have a chance to do their own inspections to confirm that there was no property damage. Title companies may include riders excluding certain kinds of disaster-related items discovered after closing (which then might impact whether lender would underwrite a loan) If any of those scenarios crop up, the rights and obligations of the parties will often be covered through existing language in the Agreement of Sale, but in most cases will just need some good old-fashioned buyer-seller negotiation to keep the transaction alive while things get worked through.

Topics

Share this post

Member Discussion

Recent Articles

-

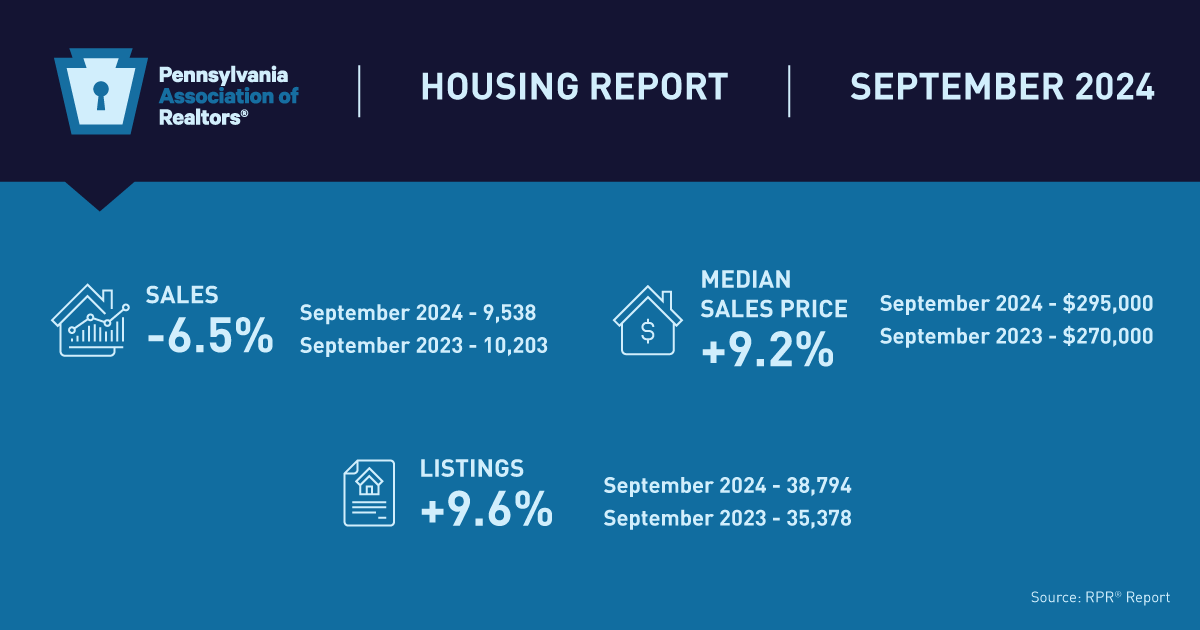

Pennsylvania Median Home Sales Price Dips Slightly, More Listings Hit the Market

- October 22, 2024

- 2 min. read

The Pennsylvania Association of Realtors®’ September housing market report shows home prices have come down a bit, but the good news is there are more homes on the market.

-

Generation E(xpat)? More Gen Z, Millennials Moving Abroad

- October 21, 2024

- 1 min. read

A recent survey showed 87% of Gen Z and millennial workers were planning on becoming digital nomads – people who work remotely while traveling.

-

Realtors® Reveal: 5 Renovation Mistakes Sellers Should Avoid

- October 18, 2024

- 3 min. read

Here are five renovation mistakes sellers should avoid, according to a few Pennsylvania Realtors®.

Daily Emails

You’ll be the first to know about real estate trends and various legal happenings. Stay up-to-date by subscribing to JustListed.