Your Appraisal Woes… Solved?

The current housing market frenzy has highlighted a new need for PAR standard forms. Faced with low inventory, buyers are making astronomical offers on properties well above the listing price. Enter the “appraisal gap,” the difference between the appraised value of the property and the already-agreed-upon purchase price of the property.

PAR already has an Appraisal Contingency Addendum to the Agreement of Sale (Form ACA), which allows a buyer to terminate the agreement if the appraisal doesn’t hit a specified value. But member feedback indicates that parties are often trying to write in stronger language to keep buyers in the deal. This new revision addresses that issue by expanding the form with a second buyer option.

Option 1 of the new Form ACA is the same “take it or leave it” that you’re used to. If the property appraises at or above the stated number, the contingency is met and the buyers move ahead under the terms of the Agreement of Sale. If the appraisal is low, the buyer can either terminate or try to negotiate changes with the seller. Nothing in this option requires either party to make any changes to the Agreement unless they want to.

Option 2 is new and highly unusual, given that it’s really more of a waiver, or a “take it or take it” option, if you will. The buyer agrees to move forward with the deal regardless of the appraised value, but under different terms depending on what the appraisal shows. If the property appraises at or above the stated number, the buyer not only agrees to move ahead, but ALSO agrees that they will change certain financial terms as necessary to ensure that they are able to close on the property at the agreed-upon sales price. For example, if it turns out the buyer needs to change the loan-to-value in the mortgage contingency to secure a different loan, or needs to bring more money to settlement, the buyer has pre-agreed that those adjustments will be made.

On the other hand, if the property does not appraise at or above the stated number the buyer still agrees to move forward, but does so under the existing terms in the Agreement of Sale. For example, if the buyer elected the mortgage contingency, then the terms of that contingency will now dictate what happens if the buyer cannot get approved for a loan based on the appraisal.

It is important to stop here and recognize what this form DOES NOT do. We’ve heard reports that some buyer agents are trying to draft language that requires sellers to adjust the purchase price of the property based on the appraised value. Nothing in Form ACA requires a change to the purchase price and if anyone says otherwise they’re wrong. (PAR takes no position on whether that sort of term should or shouldn’t be used, other than to point out that complicated clauses like that probably should be drafted by attorneys and that PAR can’t interpret anything not pre-printed in the form.)

Option 2 of the Appraisal Contingency Addendum is going to be confusing the first few times you read it – for you, for the other agent, and for both clients. Before using the revised form, you should definitely read (and re-read) the Guidelines for Preparation and Use, which contain a more in-depth explanation and some examples (with math!) of different ways the form might play out. And of course you can always call the PAR Legal Hotline with questions, but we ask that you please don’t make that call until you’ve read the guidelines and tried to think it through yourself.

Topics

Share this post

Member Discussion

Recent Articles

-

Winter Maintenance: Chimney and Heating Tips

- October 23, 2024

- 3 min. read

Experts share their insights and advice for the maintenance of chimneys and HVAC systems.

-

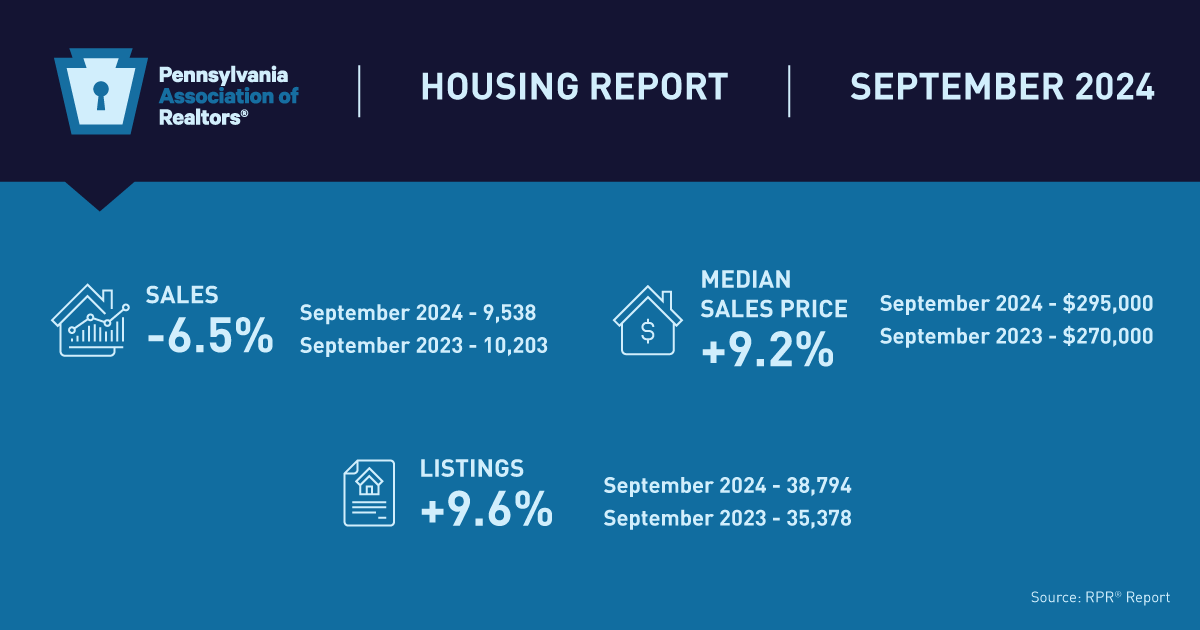

Pennsylvania Median Home Sales Price Dips Slightly, More Listings Hit the Market

- October 22, 2024

- 2 min. read

The Pennsylvania Association of Realtors®’ September housing market report shows home prices have come down a bit, but the good news is there are more homes on the market.

-

Generation E(xpat)? More Gen Z, Millennials Moving Abroad

- October 21, 2024

- 1 min. read

A recent survey showed 87% of Gen Z and millennial workers were planning on becoming digital nomads – people who work remotely while traveling.

Daily Emails

You’ll be the first to know about real estate trends and various legal happenings. Stay up-to-date by subscribing to JustListed.