TRID’s impact on standard forms

Due to the impending implementation of the TRID rules, the Standard Forms Committee appointed a task force of members to examine the Standard Forms library for potential incompatibility with the regulations.

Last month, the committee held a special session to approve changes to five forms. Here is a little bit about what you will (and won’t) see in your forms as of Sept. 18.

- A title insurance notice to buyers – A new notice has been added to the Standard Agreement for the Sale of Real Estate (Form ASR) and the Buyer’s Estimated Costs (Form BEC) intended to encourage a discussion between the buyer and the buyer’s agent about title insurance. On the Loan Estimate, title insurance is broken down between the lender’s insurance policy and the owner’s insurance policy, with the latter being described as “optional.” The lack of an owner’s policy can leave some buyers without protection from claims on the title. Buyers’ agents should encourage their clients to discuss their options for standard and enhanced policies with a title insurer.

- Two pre-settlement walkthrough inspections – TRID timelines will require the lenders to have all necessary information in hand at least one week prior to the settlement date, which means that the old practice of conducting a pre-settlement walkthrough inspection the morning of settlement could cause unnecessary delays. The committee has revised the ASR and the Pre-Settlement Walkthrough Inspection Report (Form PSW) to allow the buyer to make two pre-settlement walkthrough inspections with the idea that one would be conducted before the lender prepares the Closing Disclosure and the second would be closer to the actual settlement date.

- Buyer to provide Loan Estimate and Closing Disclosure – The Committee has added a statement to the Buyer (Tenant) Agency Contract (Form BAC) and the Non-Exclusive Buyer (Tenant) Agency Contract (Form NBA) to require the buyer to provide copies of the Loan Estimate and Closing Disclosure to his or her agent upon receipt. TRID regulations place increased responsibility for accurate disclosures on the lenders, and as a result it is more likely that the lender will be preparing these documents. However, these documents are to be provided directly to the consumer – both because of confidentiality issues and because of what the regulations require – not to the buyer’s agent. It is important for agents to be provided with these documents to ensure that the buyer is applying for a mortgage according to the terms of the Mortgage Contingency, to make sure that the timeline is being followed, and (of course) to know that closing can occur as scheduled.

- NO automatic extension period for delays in settlement – The committee opted to exclude an automatic extension of the settlement date due to a potential re-disclosure. Be assured that the task force spent hours discussing this issue before ultimately deciding against creating an automatic extension. The concern was that extending the settlement date could become the norm, instead of an exception for what will actually be a very limited circumstance. After all, a new waiting period is only required in three situations: if the APR increases by a certain amount, if the loan product changes, or if a pre-payment penalty is added. Given the fact that all of you do such a wonderful job of adapting and cooperating when the settlement date needs to change now, the committee saw no reason that this practice could not continue.

Since no one knows for certain how implementation of the new regulations will be played out in practice, these small changes were made based on the language of the law and the best guesses of some very educated people. The committee is not opposed to making other changes as they become necessary. If you see a problem occurring in your marketplace after Oct. 3, please do not hesitate to contact us.

Topics

Share this post

Member Discussion

Recent Articles

-

Winter Maintenance: Chimney and Heating Tips

- October 23, 2024

- 3 min. read

Experts share their insights and advice for the maintenance of chimneys and HVAC systems.

-

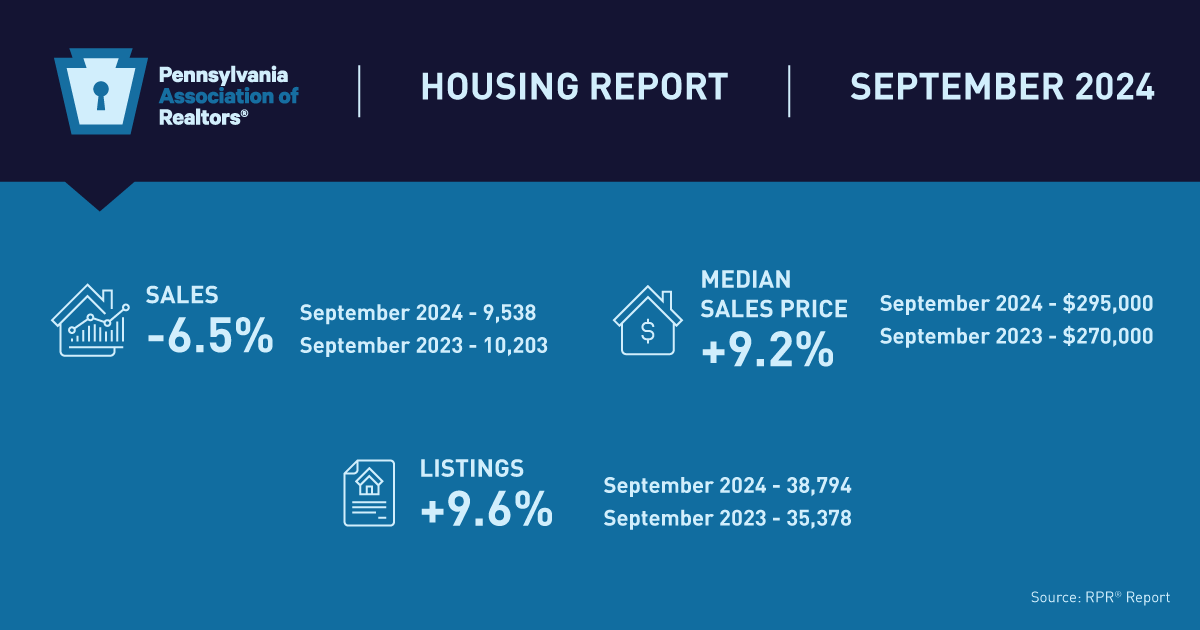

Pennsylvania Median Home Sales Price Dips Slightly, More Listings Hit the Market

- October 22, 2024

- 2 min. read

The Pennsylvania Association of Realtors®’ September housing market report shows home prices have come down a bit, but the good news is there are more homes on the market.

-

Generation E(xpat)? More Gen Z, Millennials Moving Abroad

- October 21, 2024

- 1 min. read

A recent survey showed 87% of Gen Z and millennial workers were planning on becoming digital nomads – people who work remotely while traveling.

Daily Emails

You’ll be the first to know about real estate trends and various legal happenings. Stay up-to-date by subscribing to JustListed.