Things for Your Clients to Consider If They’re Buying a Fixer-Upper

Purchasing a fixer-upper can be a viable option for clients looking to save money and take on a project. In Pennsylvania specifically, homebuyers in Philly may find more homes with fixer-upper potential, according to a report by StorageCafe.

The median asking price for a fixer-upper home in the United States is $283,000, compared to the median price of a turnkey home at $399,000.

Fixers in Philly

In Philly, which is the 10th best city for buying a fixer-upper, these homes account for 28% of the total housing inventory. Homebuyers looking to buy one in Philly can potentially save $96,400. The median asking price for a fixer-upper in the metro area is $181,500, with the median cost of renovating standing at around $75,000.

Fixer-Uppers by the Foot

Most fixer-uppers offer a smaller living space than turnkey homes. In comparison, a turnkey home averages 1,860 square feet, while a fixer-upper offers 1,550 square feet.

In Philly, the average lot size of a turnkey home is 1,307 square feet. The average lot size of a fixer-upper is significantly smaller at 871 square feet.

Financing Fixers

If your clients are interested in purchasing a fixer home, they have several financing options, including an FHA 203(k) loan, a VA renovation loan or a conventional rehab loan. Fannie Mae HomeStyle Renovation and Freddie Mac CHOICERenovation are two examples of conventional loans that can support homebuyers looking to fix up a home.

It may also be advisable for homeowners of fixer-uppers to add a contingency budget of 20% of the cost of the project. This can help cover unforeseen expenses that may pop up during the project.

Remember Inspections

It’s also important to remind clients that they should conduct a home inspection on their potential fixer-upper. This will be especially helpful to them in assessing the home for necessary repairs and upgrades that may affect their safety and well-being. This can also help homebuyers come up with a budget and a checklist for their potential fixer-upper project and help them decide if it’s a project they want to take on.

Considerations from a Realtor®

“Determine what you can change – either quickly or with time – and compromise on those things rather than the things you can’t change, like the location, topography of the lot, school district, distance from amenities, etc.,” PAR President-elect Bill Lublin advises his clients.

“Houses that need cosmetic repairs often sell for less than homes that have been recently remodeled. Still, changes to the paint and flooring can be economical and visually impactful,” he adds. “If you know the house’s ‘bones’ are solid and you can live with some less-than-current appointments, you can take your time to make more major changes.”

When thinking about buying a fixer upper, Lublin emphasizes the importance of careful consideration and compromise.

“Remember the difference between the things you wish for, the things you want and the things you need in your new home,” he tells potential buyers. “Compromising on the wishes and wants without compromising your needs is a good way to break into homeownership. Once you’ve become a homeowner, your first house will help you buy your second, and the compromises are often less at that point!”

Topics

Share this post

Member Discussion

Recent Articles

-

Winter Maintenance: Chimney and Heating Tips

- October 23, 2024

- 3 min. read

Experts share their insights and advice for the maintenance of chimneys and HVAC systems.

-

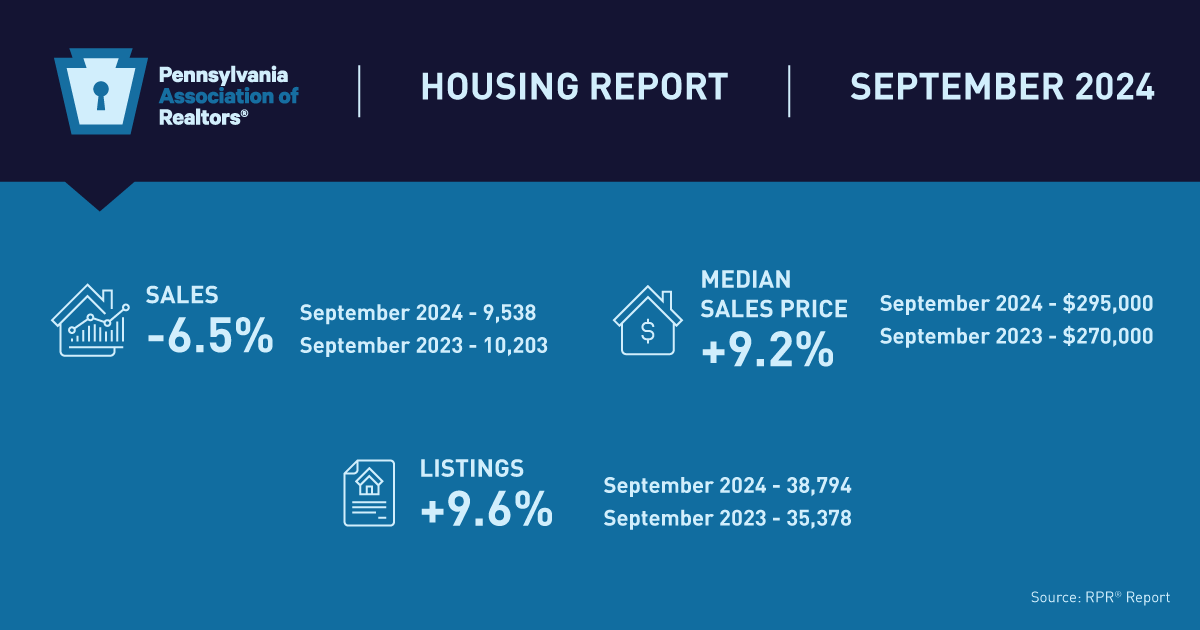

Pennsylvania Median Home Sales Price Dips Slightly, More Listings Hit the Market

- October 22, 2024

- 2 min. read

The Pennsylvania Association of Realtors®’ September housing market report shows home prices have come down a bit, but the good news is there are more homes on the market.

-

Generation E(xpat)? More Gen Z, Millennials Moving Abroad

- October 21, 2024

- 1 min. read

A recent survey showed 87% of Gen Z and millennial workers were planning on becoming digital nomads – people who work remotely while traveling.

Daily Emails

You’ll be the first to know about real estate trends and various legal happenings. Stay up-to-date by subscribing to JustListed.