NAR highlights federal priorities

The National Association of Realtors® outlined several federal priorities that affect housing during the annual convention earlier this month in Boston.

National Flood Insurance Program

Looming on the horizon is the Nov. 30 expiration of the National Flood Insurance Program.

“NAR’s message is ‘Please don’t let the program lapse’,” said Austin Perez, NAR senior policy representative. “Every time the program lapses, it puts 40,000 home sales at risk.”

However, the NFIP is not sustainable over the long term. Perez pointed to a recent Congressional Budget Office analysis showing that NFIP’s revenue falls $1.5 billion short of expected costs in an average year. That doesn’t take into account years like the past two where there have been multiple devasting floods.

In addition, the research shows that 30 counties throughout the U.S. account for 90 percent of the program’s budget short fall. “Depending on whether you live in one of those counties where the insurance rates are being subsidized, you might see the flood program either as a major benefit or cost to the taxpayer,” Perez added.

NAR continues to advocate for major reforms as well as a long-term extension of the program. “The association supports premium rate fairness, more federal assistance for risk reduction, as well as opening a market for private flood insurance. NAR continues to meet on these issues,” Perez added. “We support reasonable reform, but we don’t want them to hold home sales hostage while they work through the reform.”

“Flood insurance is one of the greatest challenges NAR faces,” added Jerry Giovaniello, NAR senior vice president of government affairs. “As an association, it’s a hard conversation when sea levels continue to rise and reaches a point in many communities where it’s flooding on sunny days.”

Association Health Plans

Association Health Plans continue to be a priority NAR is working on, according to Christie DeSanctis, NAR director of federal banking, lending and housing finance policy.

The Department of Labor issued a final rule in June expanding access to Association Health Plans. Previously, sole proprietors and contractors, including real estate professionals, were unable to join Association Health Plans. Since then, 12 states, including Pennsylvania, have sued the department, challenging the intent of the rule, such as to circumvent protection put in place by the Affordable Care Act, and in order to protect their existing insurance markets from destabilization.

“NAR has helped create a broad, multi-industry coalition to promote and preserve the Department of Labor’s final rule expanding access to AHPs,” DeSanctis said. “As part of the coalition and on an individual basis, NAR continues to advocate for expanding our membership’s access to comprehensive and quality health insurance options at both the federal and regional levels. There’s just not an overnight solution right now.”

Another barrier, in addition to the legal challenge, is states’ abilities to regulate AHPs. This creates a fragmented regulatory environment that makes insurers’ apprehensive to offer any nationwide solution at this time. NAR has been focused on better understanding these varied state regulations that may be helpful or harmful to advancing AHPs.

Perez and PAR staff and leaders recently met with the Pennsylvania Department of Insurance to discuss this issue.

“PAR members were well represented by President Todd Umbenhauer and President-elect Bill McFalls in the meeting with the insurance commissioner,” Perez noted. “The only time that heads were nodding in agreement was when your leadership were laying out the challenges that real estate professionals face when trying to access affordable health insurance.”

NAR will continue to work with federal and state regulators to protect the interests of self-employed Americans and small employers while preserving the new insurance options provided by the final rule.

Tax Reform and Rental Deduction

The 2017 tax reform act offered large corporate tax rate reductions, in addition to lowering taxes for other businesses, according to Evan Liddiard, NAR director of federal tax policy.

The reform includes a 20 percent deduction for pass-through businesses and the self-employed, which is available to owners earning taxable income below $157,500 ($315,000 for joint returns). For those with incomes above these amounts, the deduction may be available, but certain personal service businesses (including brokerage services) are excluded from the deduction if the owners’ income is above the limits.

“NAR sent a letter to Treasury requesting that real estate brokerage not be included in the prohibition, because architects and engineers were excluded,” Liddiard said. “Real estate brokers and agents also deal in tangible property, so they should be excluded as well.” As a result, the proposed rules, released in August, allow real estate professionals to claim the deduction, no matter their income.

He said NAR has sent a second letter asking for clarification on whether the deduction is available for rental income because court cases and the IRS have issued conflicting guidance. The proposed rules require owners of rental real estate to determine whether their rental activity rises to the level of a “trade or business” under Section 162 of the Internal Revenue Code in order to claim the deduction. “It’s difficult to determine whether they qualify, so we’re asking for the final rules to be clarified,” Liddiard added.

The new deduction for qualified business income should be simplified and made easily available to the 10 million Americans who report income from real estate, according to Iona Harrison, a Realtor® from Upper Marlboro, Maryland, as she testified before a public hearing held by the IRS.

“Forty percent of NAR’s membership own rental properties, so this is a huge issue for our association,” Liddiard said.

Opportunity Zones

Areas declared Opportunity Zones, a federal program created by the Tax Cuts and Jobs Act of 2017, offer a great potential for tax savings to spur economic development in low-income, distressed areas, Liddiard said. “It’s hard to see a downside for real estate in these programs,” he said.

These benefits include deferral of federal capital gains tax on amounts reinvested into an OZ (via an “Opportunity Fund”), and potential reduction in the tax ultimately paid on those gains (if held for five years, they receive a step-up in basis of 10 percent; if held for seven, 15 percent). In addition, gains accrued on investments while in an Opportunity Fund and invested into an OZ may be exempted from federal capital gains tax, if the investments are from a proper deferral election (reinvested capital gains that the tax is deferred on) and held for at least ten years.

The proposed rules provide important clarifications for interested investors, including the type of gains eligible for tax deferral (capital only), how investments into Opportunity Funds made of both capital gains proceeds and non-gains funds are treated, the overall timeline for the program, how to certify an Opportunity Fund and meet the “90 percent asset requirement” (that 90 percent of a fund’s assets be held in a OZ), and how they will determine that an Opportunity Fund has “substantially improved” a OZ business property. Further guidance is expected on other aspects of the program, and the IRS will hold a hearing on the issue on Jan. 10, 2019.

GSE Reform

Reforming the government-sponsored enterprises continues to be reviewed, with multiple comprehensive plans being introduced, but not moving forward at this time. DeSanctis said, “Reforming Fannie Mae and Freddie Mac are complex issues that are partisan, making it difficult to get much done legislatively at this time.”

The focus has shifted instead to what could be done administratively. A new director of the Federal Housing Finance Agency is expected to take office in January and NAR will continue to work closely with the administration to ensure Realtors® priorities, such as protection of the 30-year fixed rate mortgage and an explicit government guarantee, are central to any reform discussions. The association hopes to testify on this issue later this year before the House Financial Services Committee, where there will be continued push for necessary changes that promote broad market liquidity.

Topics

Share this post

Member Discussion

Recent Articles

-

Winter Maintenance: Chimney and Heating Tips

- October 23, 2024

- 3 min. read

Experts share their insights and advice for the maintenance of chimneys and HVAC systems.

-

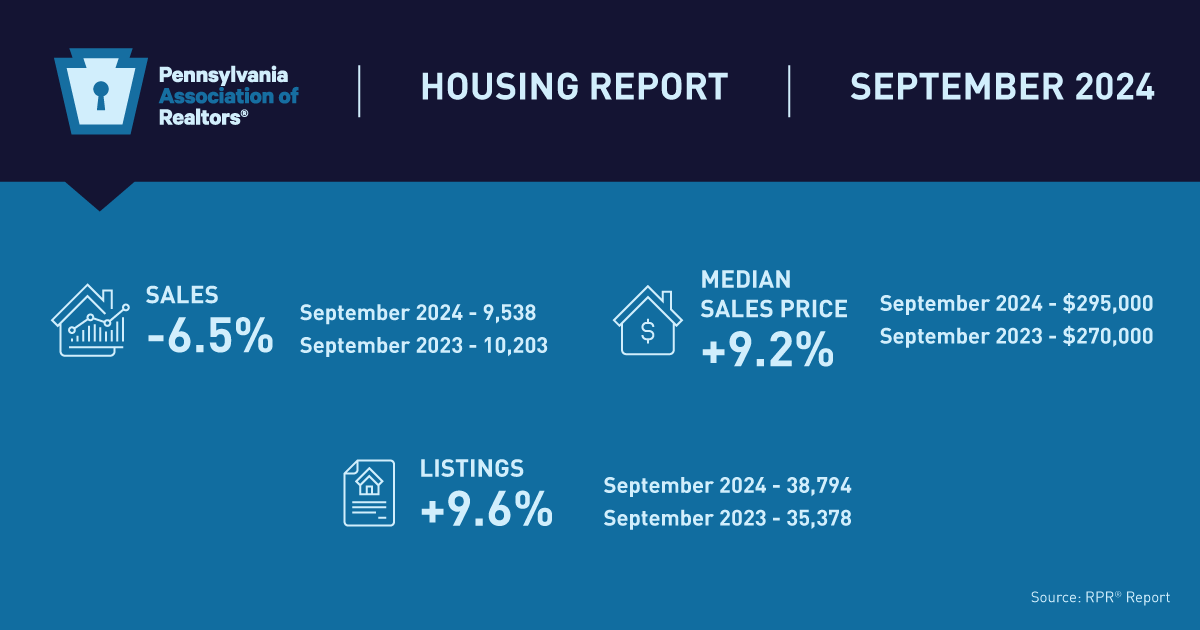

Pennsylvania Median Home Sales Price Dips Slightly, More Listings Hit the Market

- October 22, 2024

- 2 min. read

The Pennsylvania Association of Realtors®’ September housing market report shows home prices have come down a bit, but the good news is there are more homes on the market.

-

Generation E(xpat)? More Gen Z, Millennials Moving Abroad

- October 21, 2024

- 1 min. read

A recent survey showed 87% of Gen Z and millennial workers were planning on becoming digital nomads – people who work remotely while traveling.

Daily Emails

You’ll be the first to know about real estate trends and various legal happenings. Stay up-to-date by subscribing to JustListed.