Time’s running out – contact your legislator today!

The legislature has just a few days to act on the First-Time Homebuyers Savings Account legislation before session ends. PAR President Todd Umbenhauer has set a goal of getting 25 percent of members to respond to a Call-to-Action to ask legislators to move this legislation. The Senate voted SB 1066 (Mensch, R-Montgomery/Fontana, D-Allegheny) out of the Senate in late September. The bill now waits for House action.

Realtors® have sent nearly 2,400 emails to their legislators, with a response rate of 12 percent.

Across the state, Realtor® leaders see this program as being extremely important in their communities and encourage members to respond to the Call-to-Action today.

“Strategically for Pennsylvania, this new law will be critical to help retain our residents. The major anchors affecting homeownership today are the overall lack of inventory, affordability and student debt. This legislation would directly combat these issues and help support continued growth of homeownership within our state. This will positively impact all local municipalities with an average economic impact of $51,000 for the sale of a typical home. That will be a tremendous boost to each municipality. Specifically for our region, I look forward to seeing first-time buyers take advantage of this legislation and see the positive economic impact it will have on our local townships and boroughs,” Kenneth Enochs Jr., chair of the Suburban West Association of Realtors®.

Realtors® Association of Metropolitan Pittsburgh President David Dean said, “The First-Time Homebuyers Savings Account Program would make the dream of homeownership for Pittsburgh first-time buyers possible and would help the local economy – it’s a win-win for everyone.”

“The First-Time Homebuyers Savings Account Program would help so many of our clients who are first-time homebuyers save for a home, especially those struggling with college debt. In Happy Valley, it’s tough for new buyers to compete against investors buying townhouses as rental properties, or against Penn State fans who purchase second homes here rather than drop $1,000 at a hotel for a football weekend. This would give them a leg up,” said Marc McMaster, president of the Centre County Association of Realtors®.

Edwin Tichenor, president of the Greater Harrisburg Association of Realtors®, said, “There’s a vicious circle of market forces working against new buyers. New construction in our area isn’t even half of what it was before the Great Recession. People who already are in homes are staying put for lack of buying options, which further restricts availability for first-time buyers. And the lack of inventory is driving up prices for everybody. The First-Time Homebuyers Savings Account program would begin to provide relief in a simple, fair and potentially profound way.”

The program would allow Pennsylvanians to save money toward the purchase of a home and the money saved would qualify as a tax deduction on their state income tax. Parents and grandparents would be eligible to save for children and grandchildren as well. And research from the National Association of Realtors® shows that more than 80 percent of Pennsylvanians support the First-Time Homebuyers Savings Account program.

Many first-time homebuyers need help overcoming some of the obstacles to homeownership. Low wages and college debt make it difficult for young people to save money to purchase their first home. Research conducted for PAR showed that 56 percent of Pennsylvanians identified college student loans as an obstacle to homeownership. And a recent study by LendEDU ranked Pennsylvania as having the highest average college loan debt per borrower at $35,185.

Topics

Share this post

Member Discussion

Recent Articles

-

Winter Maintenance: Chimney and Heating Tips

- October 23, 2024

- 3 min. read

Experts share their insights and advice for the maintenance of chimneys and HVAC systems.

-

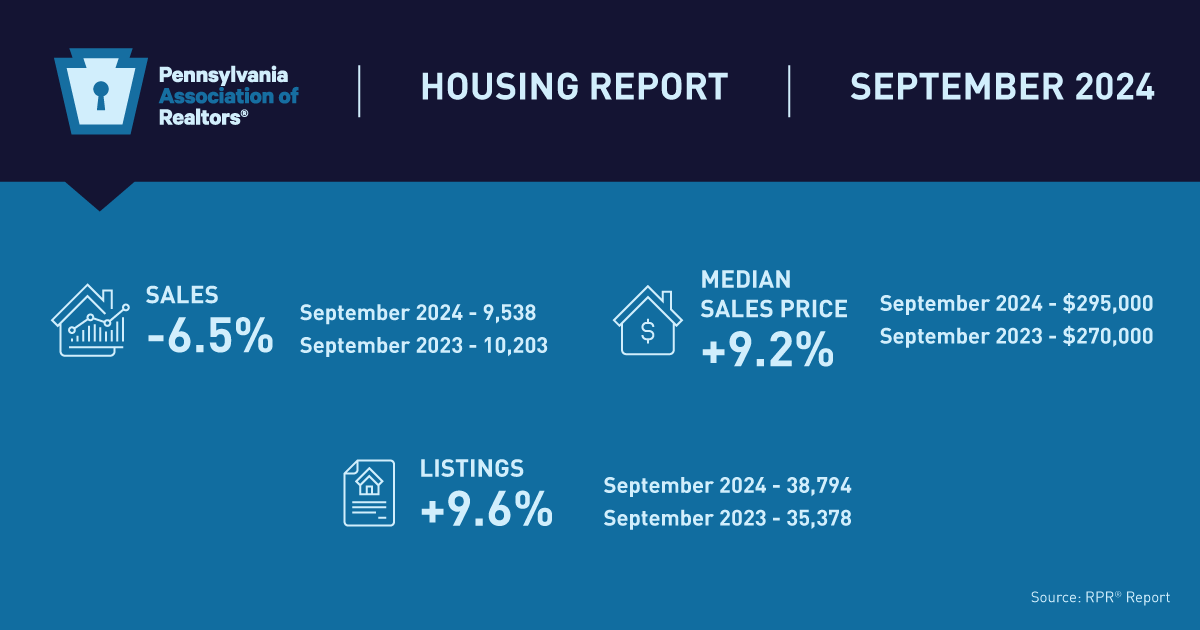

Pennsylvania Median Home Sales Price Dips Slightly, More Listings Hit the Market

- October 22, 2024

- 2 min. read

The Pennsylvania Association of Realtors®’ September housing market report shows home prices have come down a bit, but the good news is there are more homes on the market.

-

Generation E(xpat)? More Gen Z, Millennials Moving Abroad

- October 21, 2024

- 1 min. read

A recent survey showed 87% of Gen Z and millennial workers were planning on becoming digital nomads – people who work remotely while traveling.

Daily Emails

You’ll be the first to know about real estate trends and various legal happenings. Stay up-to-date by subscribing to JustListed.