Tell state legislature to pass First-Time Homebuyers Savings Account bill

Urge your state representative to vote “yes” on the First-Time Homebuyers Savings Account legislation.

As Realtors®, we’re uniquely qualified to help legislators understand the positive affect this bill would have for so many trying to achieve the American dream of homeownership. The share of first-time homebuyers in the national home sale market has fallen from 45 percent to just 32 percent since 2009, according to the National Association of Realtors®.

If passed, House Bill 128 (Brown, R-Monroe) would allow Pennsylvanians to save money toward the purchase of a home and the money saved would qualify as a tax deduction on their state income tax. Parents and grandparents would be eligible to save for children and grandchildren as well.

Our research shows that more than 80 percent of Pennsylvanians support the First-Time Homebuyers Savings Account program.

Thanks to Pennsylvania Realtors®, we saw great support among legislators for this program. Unfortunately, the legislative session ended before the bill passed. We’re pleased that legislators recognize the importance of homeownership and see the need to help Pennsylvanians achieve the dream of owning a home. Additionally, this program would provide a boost to the state’s economy.

Low wages and college debt make it difficult for first-time homebuyers to save money to purchase their first home. Research conducted for PAR showed that 56 percent of Pennsylvanians identified college student loans as an obstacle to homeownership. A study by LendEDU ranked Pennsylvania as having the highest average college loan debt per borrower at $35,185.

The First-Time Homebuyers Savings Account Program could result in an increase of home purchases of up to 4,000 annually in Pennsylvania, according to research conducted by the Anderson Economic Group. The increase in the number of home purchases would have an overall positive impact on Pennsylvania’s economy, spurring additional economic activity, job creation. It’s estimated that the economic impact could range up to $68.8 million. The increase in state tax revenues collected from realty transfer taxes, income taxes on increased earnings and sales taxes on increased consumption would exceed tax revenue forgone due to FHSA deductions.

Topics

Share this post

Member Discussion

Recent Articles

-

Winter Maintenance: Chimney and Heating Tips

- October 23, 2024

- 3 min. read

Experts share their insights and advice for the maintenance of chimneys and HVAC systems.

-

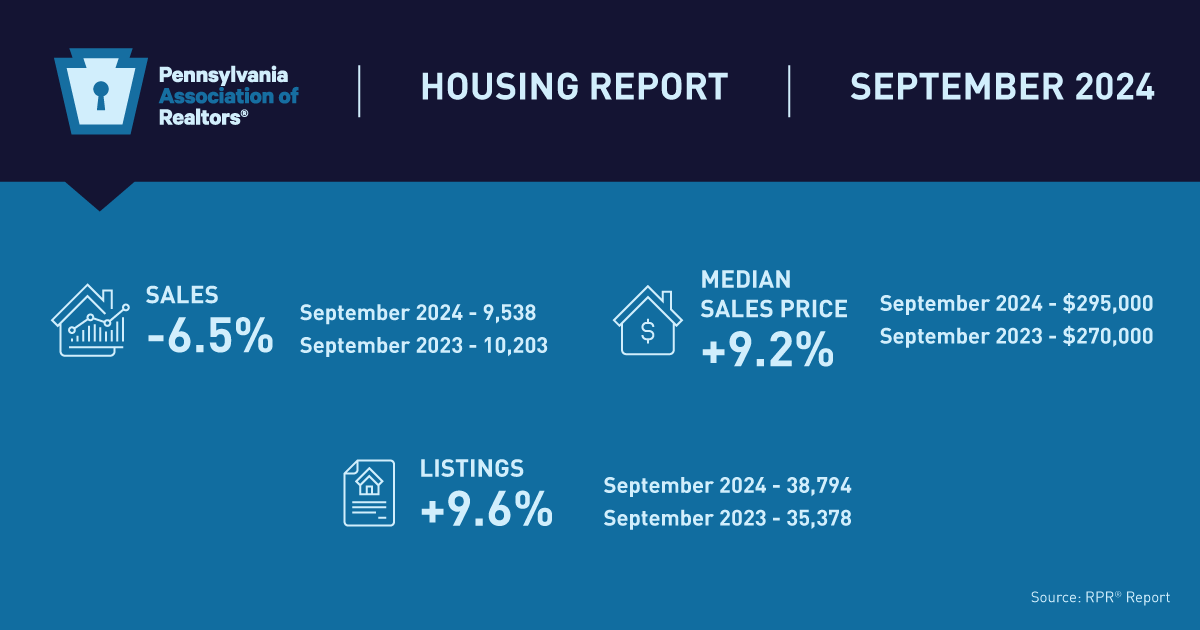

Pennsylvania Median Home Sales Price Dips Slightly, More Listings Hit the Market

- October 22, 2024

- 2 min. read

The Pennsylvania Association of Realtors®’ September housing market report shows home prices have come down a bit, but the good news is there are more homes on the market.

-

Generation E(xpat)? More Gen Z, Millennials Moving Abroad

- October 21, 2024

- 1 min. read

A recent survey showed 87% of Gen Z and millennial workers were planning on becoming digital nomads – people who work remotely while traveling.

Daily Emails

You’ll be the first to know about real estate trends and various legal happenings. Stay up-to-date by subscribing to JustListed.