Tell Congress not to let the National Flood Insurance Program lapse

The National Flood Insurance Program is set to expire on July 31. None of us want to deal with the consequences if this happens! Every time the program lapses, the real estate industry sees a loss of 40,000 property sales per month!

NAR has launched a Call-for-Action so you can tell Congress not to let the National Flood Insurance Program lapse.

Without the reauthorization of the NFIP, they cannot issue or renew flood insurance policies in the 22,000 communities where flood insurance is required for a mortgage.

Too many people falsely believe that only expensive properties sitting on the ocean are affected by flood insurance. In fact, the National Flood Insurance Program is incredibly important to Pennsylvania. Our state is 12th in the U.S. in the number of NFIP policies issued and fifth in the nation in the number of flood claims filed. Nearly every county in the state is affected – flood claims have been filed in 66 of our 67 counties.

NAR has been advocating for Congress to reauthorize the program for the next five years. The association would like to see the bill’s private market reforms retained and expanded, enabling consumers to meet federal requirements with private flood insurance offers as an alternative to NFIP policies. NAR believes building on the risk mitigation provisions would help keep rates affordable. The association also recommends the NFIP should use modern mapping technology to produce building-specific risk assessments.

Topics

Share this post

Member Discussion

Recent Articles

-

Winter Maintenance: Chimney and Heating Tips

- October 23, 2024

- 3 min. read

Experts share their insights and advice for the maintenance of chimneys and HVAC systems.

-

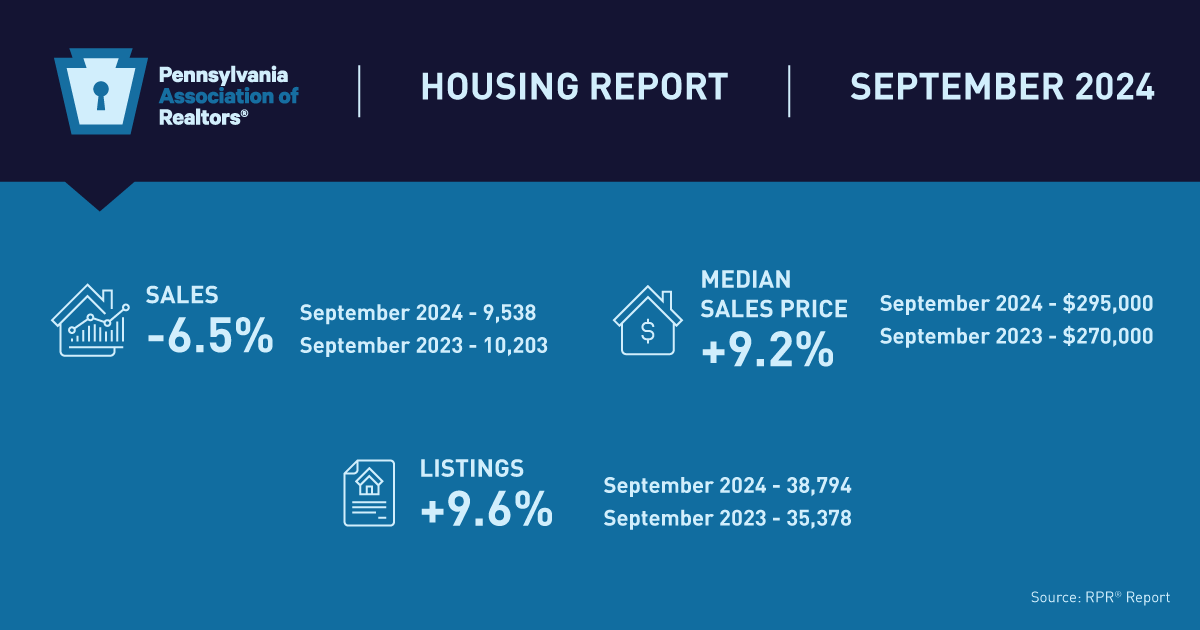

Pennsylvania Median Home Sales Price Dips Slightly, More Listings Hit the Market

- October 22, 2024

- 2 min. read

The Pennsylvania Association of Realtors®’ September housing market report shows home prices have come down a bit, but the good news is there are more homes on the market.

-

Generation E(xpat)? More Gen Z, Millennials Moving Abroad

- October 21, 2024

- 1 min. read

A recent survey showed 87% of Gen Z and millennial workers were planning on becoming digital nomads – people who work remotely while traveling.

Daily Emails

You’ll be the first to know about real estate trends and various legal happenings. Stay up-to-date by subscribing to JustListed.