Survey Says Millennials Struggle With Homebuying Knowledge

How much do millennials know about homebuying?

It’s why they need a Realtor®. According to a Lombardo Homes recent survey, 48% of millennials said they cannot confidently define the word appraisal, while a whopping 94% said the same thing about PITI, which is the acronym to represent principal, interest, taxes and insurance. Seventy-two percent said they couldn’t confidently define earnest money and the same with PMI, which is the acronym for private mortgage insurance, said 86%.

Millennials are also struggling with how much housing costs actually are. The report found that a quarter of respondents underestimated their buying means by $150,000 or more. Overall, millennials underestimated what they can afford by nearly $80,000. They also underestimated how much interest would be owed. One-third of respondents underestimated by $200,000 or more in interest, and on average, people estimated $145,000 less than they would owe. Additionally, millennials underestimated how much home values increase by $144,000, with 25% underestimating by $100,000 or more.

More than three-quarters of millennials (76%) do not know if property taxes in their area are high, medium or low, 59% don’t know the seller pays the real estate agent fees and 52% don’t know what the average home in their area costs. Additionally, 47% said they do not know what a good interest rate is.

Lack of knowledge isn’t the only thing stopping millennials. Seventy-one percent said they are struggling to save for a down payment because their rent is so high. Eighty-five percent said they can’t afford a down payment, 67% can’t afford something they want to buy and 63% said they don’t want to be tied to one area.

Topics

Share this post

Member Discussion

Recent Articles

-

Winter Maintenance: Chimney and Heating Tips

- October 23, 2024

- 3 min. read

Experts share their insights and advice for the maintenance of chimneys and HVAC systems.

-

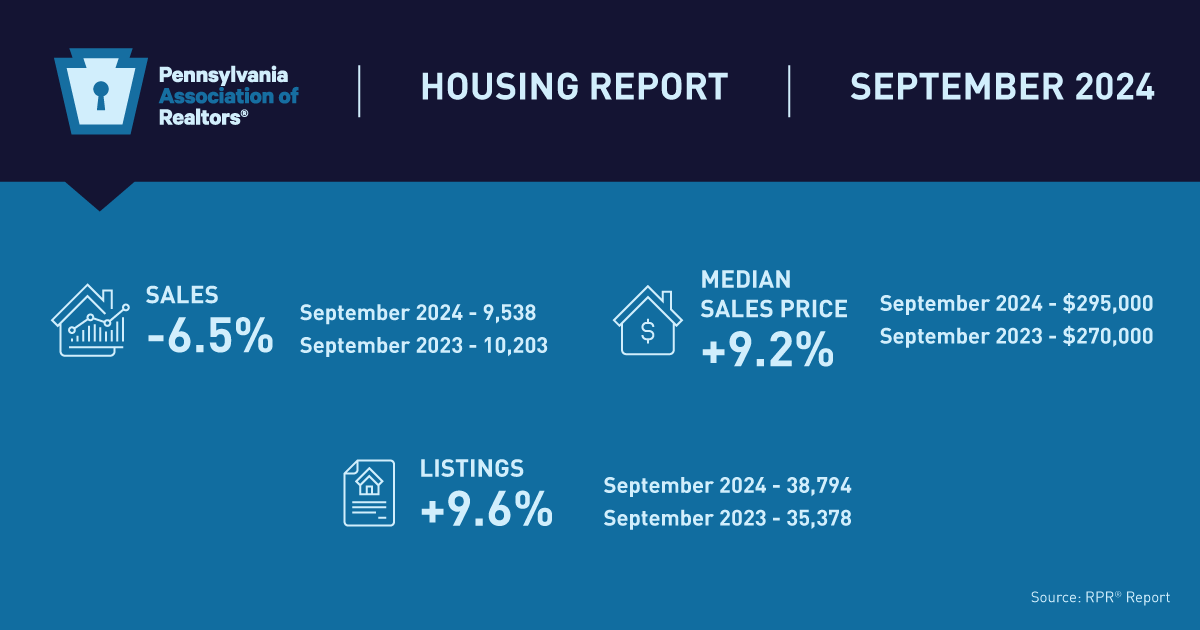

Pennsylvania Median Home Sales Price Dips Slightly, More Listings Hit the Market

- October 22, 2024

- 2 min. read

The Pennsylvania Association of Realtors®’ September housing market report shows home prices have come down a bit, but the good news is there are more homes on the market.

-

Generation E(xpat)? More Gen Z, Millennials Moving Abroad

- October 21, 2024

- 1 min. read

A recent survey showed 87% of Gen Z and millennial workers were planning on becoming digital nomads – people who work remotely while traveling.

Daily Emails

You’ll be the first to know about real estate trends and various legal happenings. Stay up-to-date by subscribing to JustListed.