Superior Court weighs in on landlord’s charging last month’s rent in advance

In a recently published opinion, the Pennsylvania Superior Court ruled in the case E.S. Management v. Yingkai Gao, et al. that a residential landlord violated Pennsylvania’s Landlord and Tenant Act by requiring tenants to pay a security deposit equivalent to two months’ rent and advance payment of the last month’s rent (discounted by $200.00).

The court further ruled that the landlord ran afoul of Pennsylvania’s Unfair Trade Practices and Consumer Protection Law, which allows the court to award punitive damages.

In this case, which originated in Allegheny County, four Chinese university students were seeking housing. At the time, the students were in China, but a friend visited the apartment which E.S. Management had available for lease and reported back to the students. To secure the apartment, the aunt of one of the students wired $5,685 to landlord, a $100 application fee, two month’s rent as a security deposit and prepayment of the final month’s rent, discounted by $200.00.

Two days after the wire transfer, the students notified E.S. Management that they could not rent the apartment because they could not agree how they would split excess utility charges pursuant to a complicated lease provision. Despite only two days having passed since receipt of the funds, the landlord refused to refund any of the prepaid funds.

Lawsuits filed by each side to the lease agreement were consolidated and ultimately tried before a jury. At the conclusion of the trial, the jury indicated its intent to award a refund of the sums paid. The trial court took up the issue of the UTPCPL and concluded that the landlord violated the law and the tenants were entitled to treble damages.

The subtitle of this article could easily be “Pigs get fat, hogs get slaughtered,” because of the excessive greed that seemed to be at play here. But there are two important lessons for members to learn when it comes to statutory compliance.

First, the LTA, in a section entitled Escrow funds limited, provides that no landlord may require a sum “in excess of two months’ rent to be deposited in escrow for the payment of damages to the leasehold premises and/or default in rent thereof during the first year of any lease.” The landlord here argued that it did not violate the LTA, as it only required two month’s rent as a security deposit and characterized the last month’s rent as a “prepayment” that was not held as security for default rent. Landlord’s argument was rejected. The court found that the purpose in requiring the deposit of sums not owed until 12 months into the future was to secure future payments, as well as to establish a fund for damages caused by tenant in violation of the lease – exactly the purpose of the security deposit. Calling the payment a name other than ‘security deposit’ did not change the purpose of the payment.

Second, and of equal interest to our members, is that the court found that landlord’s conduct “was deceptive, which created a likelihood of confusion or misunderstanding…” The court found that the 15-page, single-spaced lease with complicated pro-ration language for payment of utilities (obviously not PAR’s Residential Lease) would confuse persons with a good understanding of the English language, let alone these international students who were overseas, did not have time to consult with an attorney and who notified landlord that they would not be able to rent the apartment only two days after the payment of the security deposit and before the lease agreement was fully executed.

From the holding in this case, landlords and property managers should understand that all sums prepaid as the last month’s rent (or rent that would otherwise be paid in the future) are likely to be considered as security deposits. Labeling a prepayment as “last month’s rent” won’t change the calculation: In the first year of the lease prepayments equivalent to two month’s rent is the maximum that may be charged, and in subsequent years that amount is reduced to the equivalent of one month’s rent. The simple practice is to call these prepayments a security deposit rather than prepayment of the last month’s rent.

The additional message is that failure to charge appropriate security deposits can result in the imposition of additional damages against the landlord under the UTPCPL. UTPCPL damages are not automatic; the court would have find fraud or deceptive practices and simple mistakes generally do not constitute such behavior. Regardless, no landlord or property manager should flirt with the possibility of incurring such damages in the face in of the clear pronouncement by the Superior Court.

What should landlords and managers do now? First, assess if you’ve collected excess amounts from current tenants. Consult with counsel and consider reimbursing any excess security deposit to tenants with an explanation, preferably drafted by counsel.

Second, ensure that your business practices are compliant for future tenants. A good way to do that would be to utilize PAR’s rental forms and make sure that your usage complies with these rules. Come back tomorrow for an overview of some of the PAR forms and how to use them.

Topics

Share this post

Member Discussion

Recent Articles

-

Winter Maintenance: Chimney and Heating Tips

- October 23, 2024

- 3 min. read

Experts share their insights and advice for the maintenance of chimneys and HVAC systems.

-

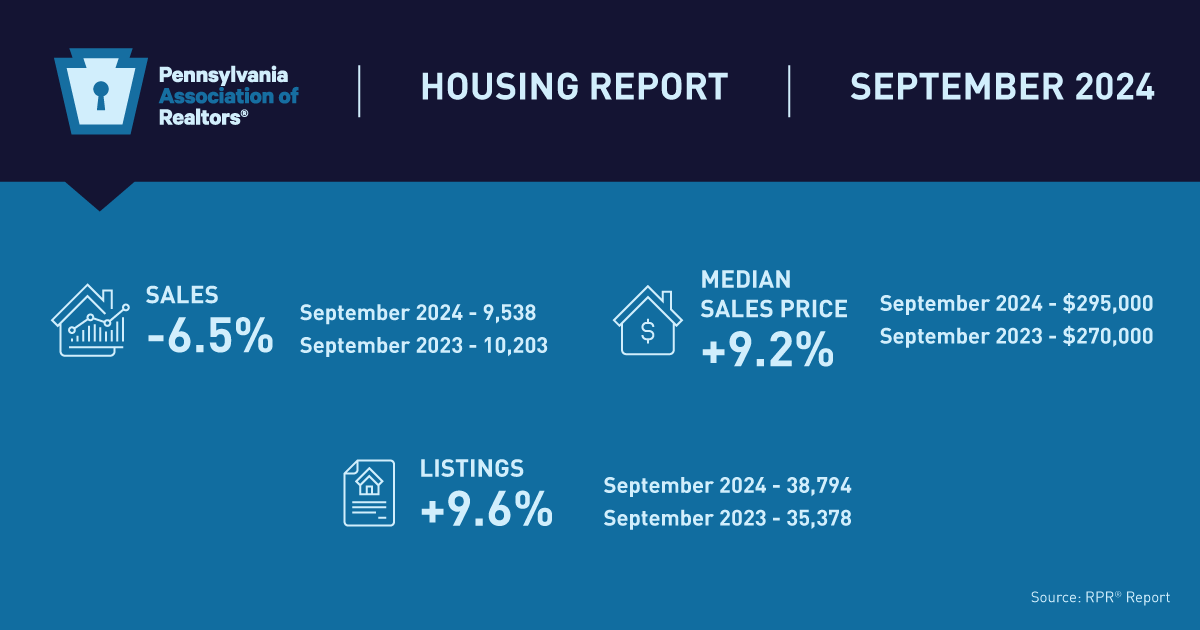

Pennsylvania Median Home Sales Price Dips Slightly, More Listings Hit the Market

- October 22, 2024

- 2 min. read

The Pennsylvania Association of Realtors®’ September housing market report shows home prices have come down a bit, but the good news is there are more homes on the market.

-

Generation E(xpat)? More Gen Z, Millennials Moving Abroad

- October 21, 2024

- 1 min. read

A recent survey showed 87% of Gen Z and millennial workers were planning on becoming digital nomads – people who work remotely while traveling.

Daily Emails

You’ll be the first to know about real estate trends and various legal happenings. Stay up-to-date by subscribing to JustListed.