Sellers Still Seeing High Profit Margins

Despite a slowing market, sellers saw a 44.2% profit margin on a median-priced property in the first quarter of 2023.

According to ATTOM, it’s a decrease from 48.7% profit margin in the last quarter of 2022, the third consecutive quarterly drop, as home prices have remained stable over the past few months. The report found that the median home price was $321,135, up 1% from the fourth quarter, but down in the majority of areas across the country. Prices remained the same or dropped in three-quarters of metros quarterly, but were up annually in 73% of metros. Pittsburgh had a large drop in median home prices, falling 11.1%.

Purchase profits remained the same or dipped in 68% of metros compared to the fourth quarter and the same or lower in 90% year over year. Nearly one-third (32%) saw profit margins increase. Scranton and Reading had two of the biggest quarterly gains in profits. In Scranton profits rose from 63.3% to 87.5% and in Reading, they grew from 53.9% to 68.8%. Pittsburgh had the largest gain in metros with a population of 1 million or more. In the Steel City, profits increased from 47.8% to 51.1% quarterly.

Sellers were also staying in their homes for shorter periods. Sellers who sold their property in the first quarter owned their homes for 5.59 years on average, a 12-year low.

All-cash sales continue to reign in the market. All-cash sales represented 39.2% of sales, a 10-year high. It’s an increase of 1.4% from the fourth quarter and 2.4% year over year. Investors purchased 5.4% (or one of every 19) of single-family homes and condos. FHA-backed loans accounted for 8.3% of all sales, or one in 12.

Topics

Share this post

Member Discussion

Recent Articles

-

Winter Maintenance: Chimney and Heating Tips

- October 23, 2024

- 3 min. read

Experts share their insights and advice for the maintenance of chimneys and HVAC systems.

-

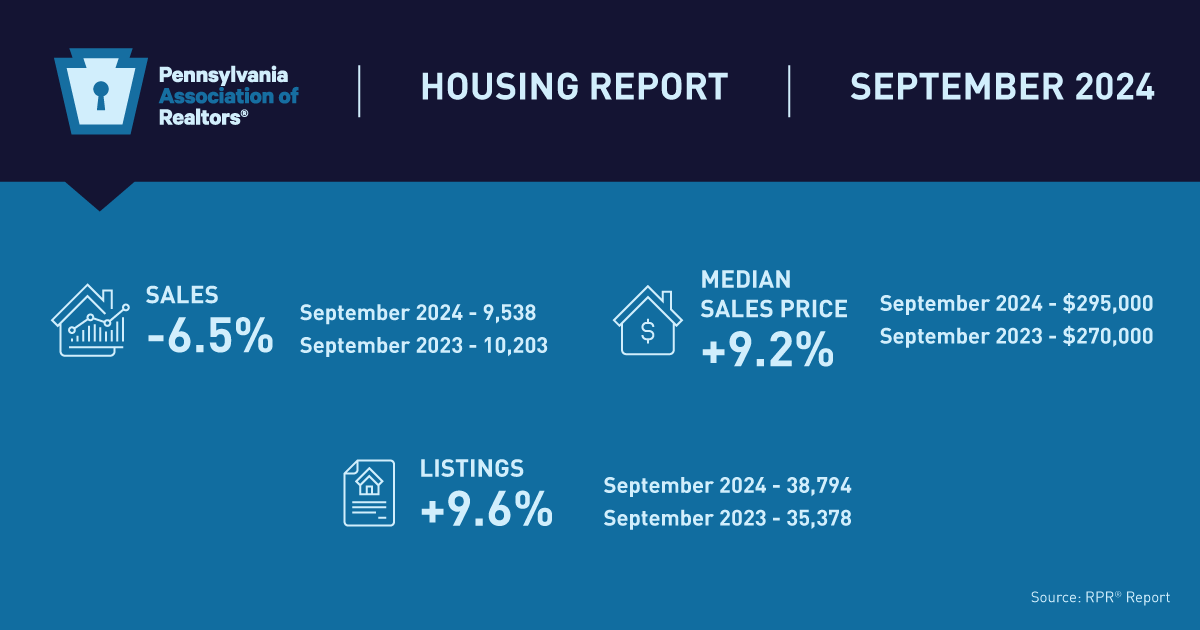

Pennsylvania Median Home Sales Price Dips Slightly, More Listings Hit the Market

- October 22, 2024

- 2 min. read

The Pennsylvania Association of Realtors®’ September housing market report shows home prices have come down a bit, but the good news is there are more homes on the market.

-

Generation E(xpat)? More Gen Z, Millennials Moving Abroad

- October 21, 2024

- 1 min. read

A recent survey showed 87% of Gen Z and millennial workers were planning on becoming digital nomads – people who work remotely while traveling.

Daily Emails

You’ll be the first to know about real estate trends and various legal happenings. Stay up-to-date by subscribing to JustListed.