NAR Legislative Advocacy Updates

NAR’s advocacy efforts this year are focused on three areas: improving access to homeownership, building strong and resilient communities and ensuring fair housing for all. And they are devoting extra attention to reinvigorating a change in commercial real estate landscape.

NAR’s Chief Advocacy Officer Shannon McGahn recently gave an update on the association’s 2021 federal priority issues during the virtual Realtors® Legislative Meetings.

She noted that NAR has tremendous reach in its legislative advocacy, adding that it’s vital for Realtors® to go beyond the talking points. “It’s important to paint the picture around talking points to drive home the goals and to be the person, the story, that lawmakers remember at the end of the day.”

NAR is monitoring proposals that could restrict the independent contractor status. Policymakers and regulators are looking to address changes in the U.S. workforce brought about by the rise of the “gig economy.” The PRO Act would not revoke Realtors®’ independent contractor status outright, however, it could create a situation where conflicting federal and state laws would make it difficult for Realtors® to continue operating as independent contractors.

Nia Duggins, NAR’s policy representative for business issues, said, “More than 87% of NAR’s 1.4 million members are classified as independent contractors. This is something that we are messaging to members of Congress and their staff. It’s important to emphasize that Realtors® enjoy being independent contractors. They enjoy the flexibility and freedom to set their schedules and just the autonomy that being an independent contractor provides.”

NAR Senior Policy Representative for Federal Taxation Evan Liddiard outlined several issues related to housing supply, tax incentives and 1031 like-kind exchanges. For the commercial real estate market, which has been hard hit by the pandemic, Liddiard sees two ideas for helping the industry.

“The first one is the tax credit to help offset or lower the cost of converting used or underutilized commercial property into residential units. By doing so, we could have a four-way win by bolstering the commercial real estate market by taking some of that excess space off the market and keeping rates up for those that are left. By creating more residential units, it would make more places to buy or to rent available from affordable housing to medium housing to high-end – it could help all across the board. Such a move would create lots of jobs and a huge amount of economic growth because there would be all these people working to convert those units. And finally, the result of all that would be more revenue at every level of government from the federal, state and to the local because of transfer fees and other payroll taxes. It could help this country in all those different ways,” he said.

Liddiard said NAR believes offering an incentive to those who have single-family rental homes to rent to get them to sell them to first-time homebuyers would be beneficial. “More than 3 million homes were converted from owner-occupied to single-family rentals since the Great Recession. If only a few hundred thousand were to go back in the pool for owner-occupied, it could help solve the problem of there not being enough homes out there for people to buy,” he said.

Liddiard noted that with housing inventory at a 50-year low, NAR is encouraging support of the Housing Supply and Affordability Act, which would create a local housing policy grant program for cities and states to enact pro-housing policies at the local level.

“With the supply of homes for sale being so low, it’s also important for that we have tax incentives and other incentives to spur the creation of more residential units,” he said.

The other provision already introduced is the Neighborhood Homes Investment Act, which would invest all private sector money and tax credits to disadvantaged neighborhoods and begin fixing the houses up one by one. It’s estimated that 500,000 homes and other buildings could be rehabilitated in this program.

Liddiard said it’s also important to emphasize the importance of preserving the 1031 like-kind exchanges. “A lot of times, members of Congress and their staff don’t always understand the value of the 1031 and how it’s the lifeblood of commercial real estate and key to how important it is to affordable housing as well,” he said. “Explaining that to them and telling them this would be a mistake, especially now, to cap the 1031 or take it away. We urge you to share that with members of Congress.”

NAR is collecting input from members about their personal experiences with 1031s to share with members of Congress. Share your personal stories with NAR about how you used 1031 to bring development and economic benefits here in Pennsylvania using this link.

Fair housing is one of NAR’s top priorities this year. “Over generations, many qualified buyers of color have been shut out of opportunities to build wealth through homeownership. And discrimination continues today across the housing ecosystem, including real estate,” said NAR’s Senior Policy Representative for Fair Housing Alexia Smokler.

NAR is advocating a multi-pronged approach to fair housing. NAR is combating present-day discrimination in the housing market by closing racial homeownership and wealth gaps, supporting increased resources for fair housing enforcement and amending the Fair Housing Act to prohibit discrimination based on sexual orientation and gender identity.

Smokler noted, “We have a racial homeownership gap today in 2021 that is the same as it was when discrimination was still legal 50 years ago. That racial homeownership gap is a large contributor to the racial wealth gap.”

NAR is advocating for passage of The Housing Fairness Act S. 769 and H.R. 68, increasing HUD’s Fair Housing Initiatives Program by $18 million increasing funding for HUD’s Office of Fair Housing and Equal Opportunity by $20 million for 2022.

To read more, visit nar.realtor.

Topics

Share this post

Member Discussion

Recent Articles

-

Winter Maintenance: Chimney and Heating Tips

- October 23, 2024

- 3 min. read

Experts share their insights and advice for the maintenance of chimneys and HVAC systems.

-

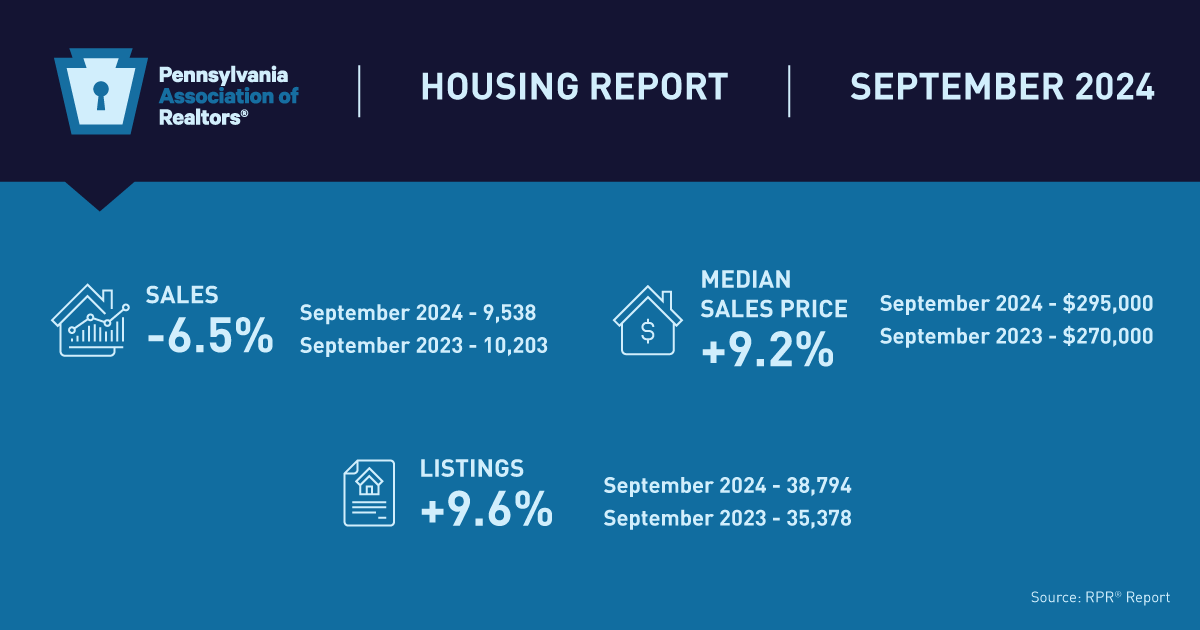

Pennsylvania Median Home Sales Price Dips Slightly, More Listings Hit the Market

- October 22, 2024

- 2 min. read

The Pennsylvania Association of Realtors®’ September housing market report shows home prices have come down a bit, but the good news is there are more homes on the market.

-

Generation E(xpat)? More Gen Z, Millennials Moving Abroad

- October 21, 2024

- 1 min. read

A recent survey showed 87% of Gen Z and millennial workers were planning on becoming digital nomads – people who work remotely while traveling.

Daily Emails

You’ll be the first to know about real estate trends and various legal happenings. Stay up-to-date by subscribing to JustListed.