Mortgage rates near all-time low

Thanks to the Brexit vote, average fixed mortgage rates have dropped to 3.41 percent, according to Freddie Mac.

The results of the Primary Mortgage Market Survey® revealed the new low, which is just .10 percent higher, or 10 basis points, than the lowest rates on record from November 2012 for a 30-year fixed-mortgage rate.

Compared to this time last year, when the 30-year fixed-rate mortgage averaged 4.04 percent, this is a significant decrease. Compared to earlier this month, the 30-year fixed-rate mortgage is down .07 percent, as it had averaged 3.48 percent.

Also, the 15-year fixed-rate mortgage had an average of 2.74 percent, down an average of 0.4 point from earlier this month, when it was 2.78 percent. Comparatively, at this time last year, the average for the 15-year fixed-rate mortgage was 3.20 percent, up .46 percent.

As for the 5-year Treasury-indexed hybrid adjustable-rate mortgage, it averaged 2.68 percent, down .02 from earlier this month when it was 2.70. Compared to this time last year, when it was 2.93, it is down .25 percent.

“Continuing fallout from the Brexit vote drove Treasury yields lower again this week. The 30-year fixed-rate mortgage followed Treasury yields, falling 7 basis points to 3.41 percent in this week’s survey. Mortgage rates have now dropped 15 basis points over the past two weeks, leaving them only 10 basis points above the all-time low,” said Sean Becketti, chief economist for Freddie Mac.

According to the Washington Post, thanks to an increase in refinances, mortgage applications have increased recently, according to the latest data from the Mortgage Bankers Association.

Topics

Share this post

Member Discussion

Recent Articles

-

Winter Maintenance: Chimney and Heating Tips

- October 23, 2024

- 3 min. read

Experts share their insights and advice for the maintenance of chimneys and HVAC systems.

-

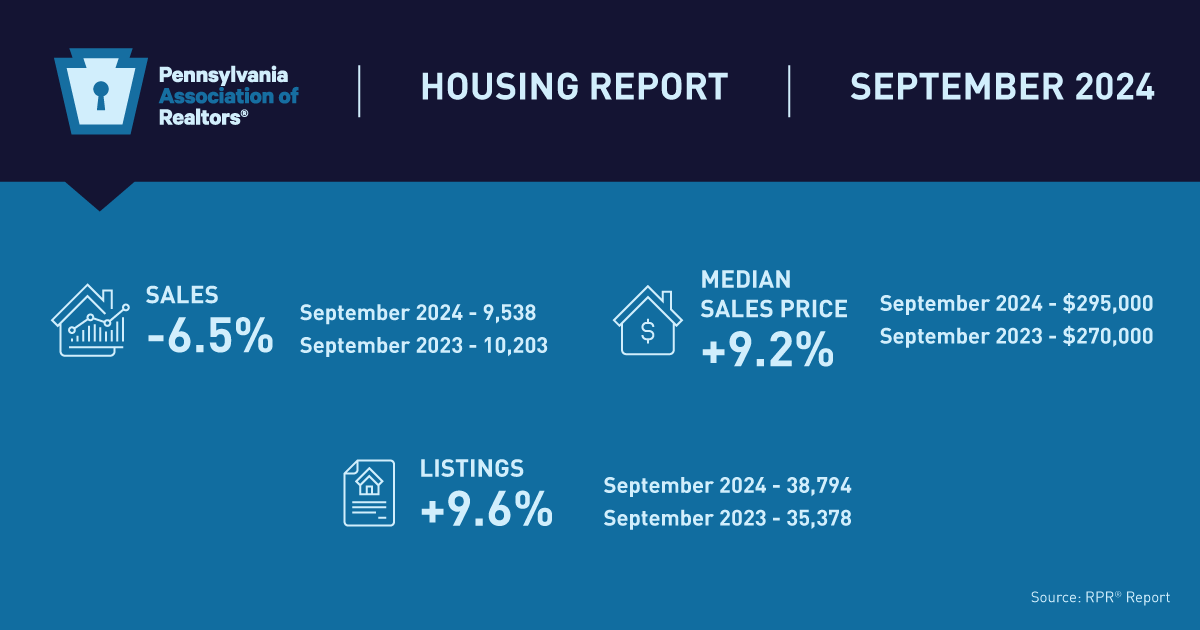

Pennsylvania Median Home Sales Price Dips Slightly, More Listings Hit the Market

- October 22, 2024

- 2 min. read

The Pennsylvania Association of Realtors®’ September housing market report shows home prices have come down a bit, but the good news is there are more homes on the market.

-

Generation E(xpat)? More Gen Z, Millennials Moving Abroad

- October 21, 2024

- 1 min. read

A recent survey showed 87% of Gen Z and millennial workers were planning on becoming digital nomads – people who work remotely while traveling.

Daily Emails

You’ll be the first to know about real estate trends and various legal happenings. Stay up-to-date by subscribing to JustListed.