Deposits: Too little, too late

To state that the typical deposit is too low an amount and that it is paid later than should be is not an overstatement.

The purchase deposit, which is referred to as “initial deposit” in the Agreement of Sale, is paid within five days of execution. Why a deposit? It is not a legal requirement of a binding contract. Don’t confuse a deposit with “consideration,” which is essential in the formation of a binding contract. No, a deposit is not legally required, but it is a good idea, assuming that it is of a sufficient amount. A sufficient deposit is a better telltale of the buyer’s interest than of the buyer’s stated expressions of love for the home. Money talks.

A deposit also serves to protect against financial damage suffered by seller in the event of buyer’s breach. If left alone, the seller may, upon buyer default, retain the full amount of the deposit and apply it to the actual damages suffered by seller or to the full purchase price or to retain it as a liquidated damage in lieu of actual losses incurred. Even if the agreement did not include any provision regarding seller’s remedies, the seller would enjoy the benefit of Pennsylvania law and could seek actual damages incurred or sue for the purchase price.

By checking the paragraph in the default clause, the seller is left with a remedy that the law would not provide: a liquidated damage (under the agreement, the liquidated damage is the amount of sums paid on account of the purchase price). A liquidated damage is a damage based on contract that is generally used when actual damages are difficult to quantify. Consider a road contractor’s agreement with the commonwealth providing for delivery of a finished road by a date certain. What is the harm to the commonwealth arising from untimely completion by the contractor? These contracts provide a liquidated damage in the form of a per diem amount.

The standard agreement allows the buyer and seller to agree that in the event of buyer default, seller is limited to retaining sums paid. Sums paid on account of the purchase price are rarely anything beyond the deposit(s). If a greater deposit paid at the execution of the agreement increases the likelihood of settlement, why isn’t it the norm? The argument I hear is that buyer agents want to guard against their client’s money being tied up when the deal goes bad, which frequently precludes their buyers from paying a deposit on the next transaction. It is true that a seller can tie-up a buyer’s deposit pending the outcome of mediation or litigation. That is a weak explanation for the $1,000 and $2,000 deposits I see as the norm across the state.

It’s one thing to advocate for your client, it’s another to make it easy for a buyer to default on a purchase agreement. We’re not talking about a buyer who justifiably terminates on the basis of an inspection or other contingency. These buyers should get their money back immediately and maybe there should be a penalty to pay when refusal to release the deposit is unreasonable. It’s equally disturbing when a buyer walks from a transaction without justification, perhaps only because they found something better.

A substantial percentage of hotline calls involve deposits and their entitlement. My first question is how much deposit is in escrow. Most frequently the amount is $2,000 or less! In these cases, the answer may be irrelevant because litigation costs will exceed that amount. If buyers are willing to pay amounts over list price to purchase a house, they are willing to walk away from a $1,000 or $2,000 deposit, if it means they can buy another property they like better than the one under contract.

There is nothing stated above that is new to you, so let me get to the point. The standard Agreement of Sale does not dictate a norm. The norm is not to have an agreement funded by a deposit paid five days after execution. It is one option among a near infinitive number of options. If the parties agree, a deposit could be paid 30 days post execution or on the day of execution. Terms are negotiable and not set by default or norms.

Why would any seller agree to the buyer paying a nominal deposit five days after execution when that deposit is a liquidated damage barring seller’s recovery of actual damages? The buyer could tie up a dozen houses this way and take those five days, or more, and decide which one he seeks to acquire. What recourse do the sellers have? Their remedy is to retain sums paid (past tense) when in fact none of these sellers has received anything

Why would any reasonable seller allow the buyer’s deposit to be the seller’s sole remedy before a deposit is even posted? A simpler question is why would anyone agree to limit a seller’s recovery to an amount below actual losses when a buyer defaults?

It would be nice if buyer agents could tell their buyers that unless a reasonable amount is posted as a deposit, they will remain on the hook for seller’s actual losses in the event a breach. It would be nice for buyer agents to advise their buyers that a low deposit coupled with the check mark for liquidated damages will likely not be accepted. It would be nice that once buyers make a decision that they remain committed to the purchase unless an inspection reveals problems not previously identified or unless the buyer, following a good-faith mortgage application, is denied financing.

Do not assume that the standard agreement suggests the check mark or the payment of the deposit in five days. The standard agreement includes default time limits only to assure that an agent does not fail to specify a date. It is intended as a fail-safe, not a suggestion of what the norm is or what should be. The checkbox is not included because those who create standard forms suggested it as a default. It is an election to be negotiated like any other term of the agreement.

I look forward to the day when I ask a hotline caller the amount of the deposit and whether a check mark is found in the liquidated damage clause and hear something other than $2,000 and “yes” there is a check mark!

Topics

Share this post

Member Discussion

Recent Articles

-

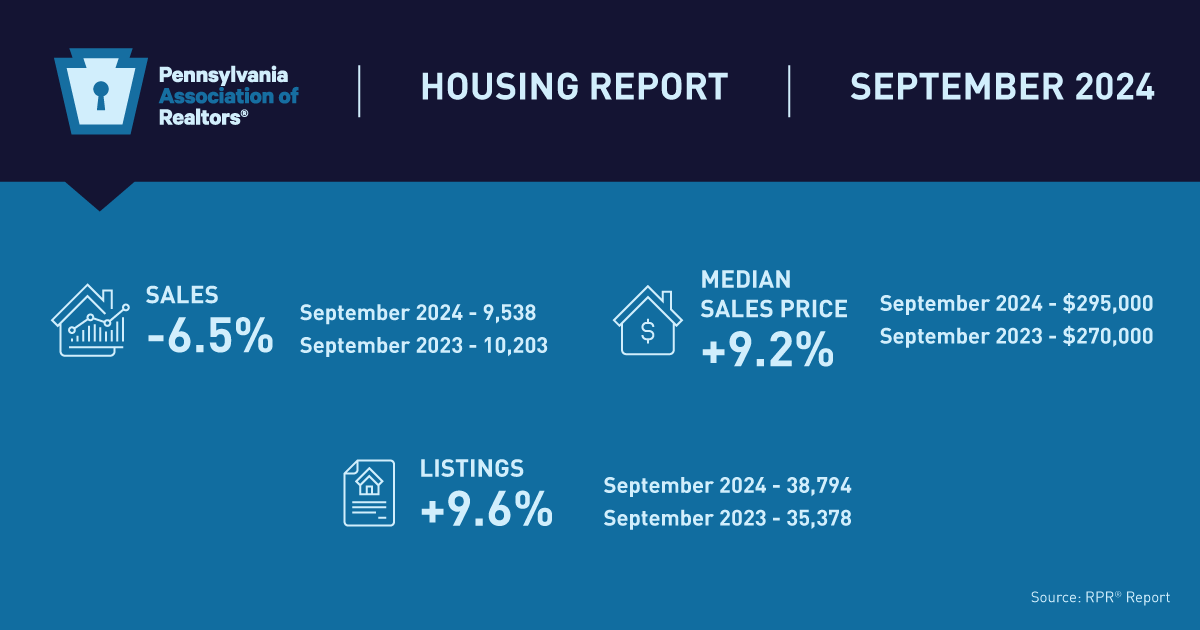

Pennsylvania Median Home Sales Price Dips Slightly, More Listings Hit the Market

- October 22, 2024

- 2 min. read

The Pennsylvania Association of Realtors®’ September housing market report shows home prices have come down a bit, but the good news is there are more homes on the market.

-

Generation E(xpat)? More Gen Z, Millennials Moving Abroad

- October 21, 2024

- 1 min. read

A recent survey showed 87% of Gen Z and millennial workers were planning on becoming digital nomads – people who work remotely while traveling.

-

Realtors® Reveal: 5 Renovation Mistakes Sellers Should Avoid

- October 18, 2024

- 3 min. read

Here are five renovation mistakes sellers should avoid, according to a few Pennsylvania Realtors®.

Daily Emails

You’ll be the first to know about real estate trends and various legal happenings. Stay up-to-date by subscribing to JustListed.