CFPB begins tougher AfBA enforcement

Affiliated Business Arrangements (AfBA) and Marketing Services Agreements (MSA) are similar concepts; one might call them ‘kissing cousins.’ Both AfBAs and MSAs are arrangements through which settlement service providers work together to offer various services to consumers. AfBAs have been around for decades, while MSAs are relatively new creatures. AfBAs are generally accepted by the Consumer Financial Protection Bureau (CFPB) but all indications are the CFPB will start with a presumption that MSAs violate the Real Estate Settlement Procedures Act (RESPA).

What do you need to know about AfBAs to minimize coming under the fire of the CFPB?

- AfBAs are lawful under RESPA, provided they are structured and managed in accordance with RESPA.

- RESPA Section 8 prohibits both paying and receiving referral fees, as well as being paid for work that was not performed.

- In order to satisfy the requirements of RESPA, the AfBA must:

- Provide a written disclosure at the time the AfBA was referred, and the disclosure must include an estimate of the costs;

- Provide the consumer with the option to choose another provider; and

- Provide earnings to owners based strictly on their ownership interest in the AfBA.

The CFPB has prosecuted various settlement service providers for failing to meet these criteria. For example, a real estate brokerage in Alabama was fined $500,000 because it did not use an AfBA disclosure that satisfied RESPA. In a separate instance, the CFPB has brought suit against a Kentucky law firm claiming the nine separate AfBAs were really sham businesses designed to try and circumvent the prohibitions against paying and receiving referral fees.

What are some guiding principles for developing an AfBA that complies with RESPA?

- Have a viable business model that will permit your business to operate independent of one another if necessary.

- Have at least one dedicated employee for the AfBA.

- Ensure there is sufficient capital, space and employees to allow it to function as an independent business.

- Understand what the ‘break-even’ point for the business is and have a business plan to meet or exceed that point.

- Make sure there is NO agreement among the partners (written or oral) that business is expected to be referred to the AfBA.

The CFPB has taken note of AfBAs and of MSAs, and the CFPB is looking at them to determine whether they are legitimate business arrangements, or whether they are sham businesses with the sole purpose of capturing business (by paying referral fees or offering other incentives). Now is probably a good time to revisit any affiliates with which you may be involved, review policies and procedures to verify everyone understands what their obligations and limitations are, and have your documentation reviewed by counsel who are familiar with the new ways in which RESPA is being enforced.

Editor’s note: This is the third of a three-part series on RESPA changes. Read the first article in the series: “Just what is the CFPB?” and the second: “Closing Disclosure Statement: Time is of the essence.”

Topics

Share this post

Member Discussion

Recent Articles

-

Winter Maintenance: Chimney and Heating Tips

- October 23, 2024

- 3 min. read

Experts share their insights and advice for the maintenance of chimneys and HVAC systems.

-

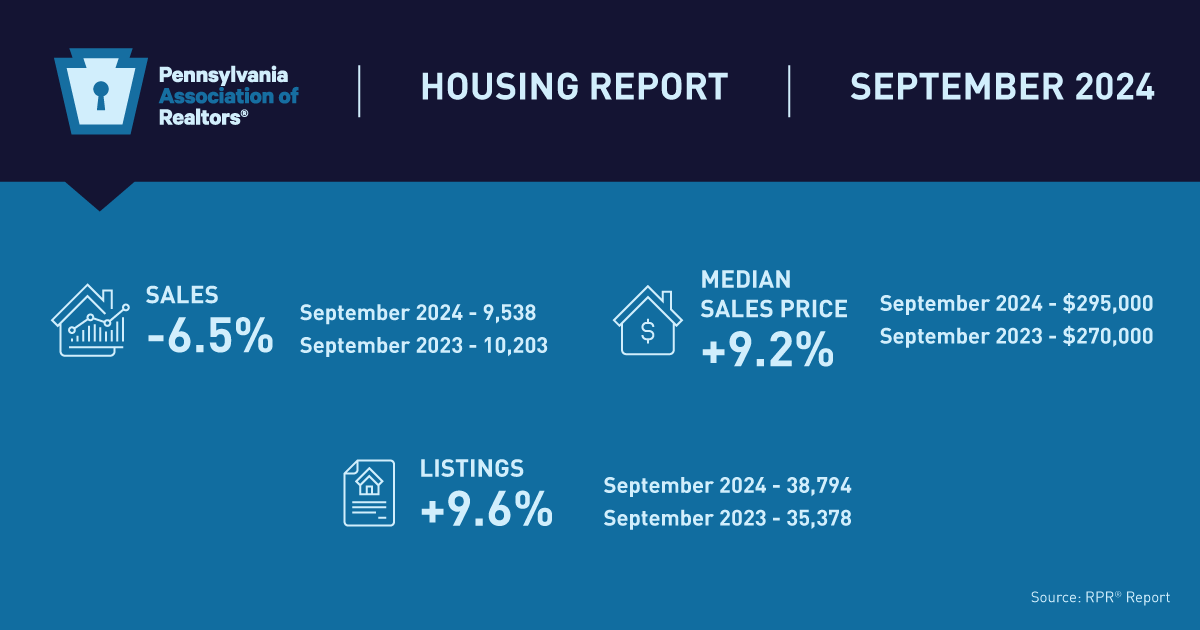

Pennsylvania Median Home Sales Price Dips Slightly, More Listings Hit the Market

- October 22, 2024

- 2 min. read

The Pennsylvania Association of Realtors®’ September housing market report shows home prices have come down a bit, but the good news is there are more homes on the market.

-

Generation E(xpat)? More Gen Z, Millennials Moving Abroad

- October 21, 2024

- 1 min. read

A recent survey showed 87% of Gen Z and millennial workers were planning on becoming digital nomads – people who work remotely while traveling.

Daily Emails

You’ll be the first to know about real estate trends and various legal happenings. Stay up-to-date by subscribing to JustListed.